Decoding 7 Days Performance: The UK Market Advantage

UK investors are often drawn to the short-term excitement of the market, hoping for quick profits. However, focusing solely on daily performance can be misleading due to the inherent volatility. Analyzing 7 days performance provides a more balanced approach.

This weekly perspective helps filter out the daily “noise” while still capturing important emerging trends. These trends are often missed in longer-term monthly analyses.

This 7-day lens offers valuable insights into the UK market, particularly its influence on the FTSE 100. The FTSE 100 often shows patterns within these weekly cycles, revealing potential opportunities for savvy investors. This timeframe captures both immediate reactions to market events and the development of more sustained trends. It’s a valuable tool for identifying optimal entry and exit points.

Understanding the nuances of the UK market is crucial for effectively using 7 days performance. In the first four months of 2025, the FTSE 100 saw a 5.26% increase, reaching a high of 8908.91 points in March. This happened despite daily fluctuations and mixed economic signals like rising unemployment and slowing wage growth. This highlights the complex factors influencing weekly market outcomes in the UK. For more detailed statistics, see Trading Economics UK Stock Market.

Why LuckyTurbo and 7 Days Performance Align

The 7 days performance analysis is particularly beneficial for LuckyTurbo participants. Understanding weekly trends allows for more informed decisions about when to enter competitions.

Strategic timing can potentially improve winning chances by aligning entries with periods of positive market momentum.

Practical Applications of 7 Days Performance on LuckyTurbo

How can you use this knowledge on LuckyTurbo? Here are some practical applications:

- Strategic Timing: Identify periods of positive 7-day market performance that might correlate with larger prize pools or increased participant activity.

- Bankroll Management: Distribute your competition budget strategically throughout the week, potentially increasing entries during periods of predicted positive performance.

- Prize Selection: Consider competitions with prizes aligned with sectors demonstrating strong 7-day performance. For instance, if the tech sector is thriving, consider competitions featuring tech gadgets.

Understanding 7 days performance allows for a more strategic and data-driven approach to LuckyTurbo. It moves beyond relying on chance and toward informed decision-making.

The Hidden Drivers Behind 7 Days Performance Trends

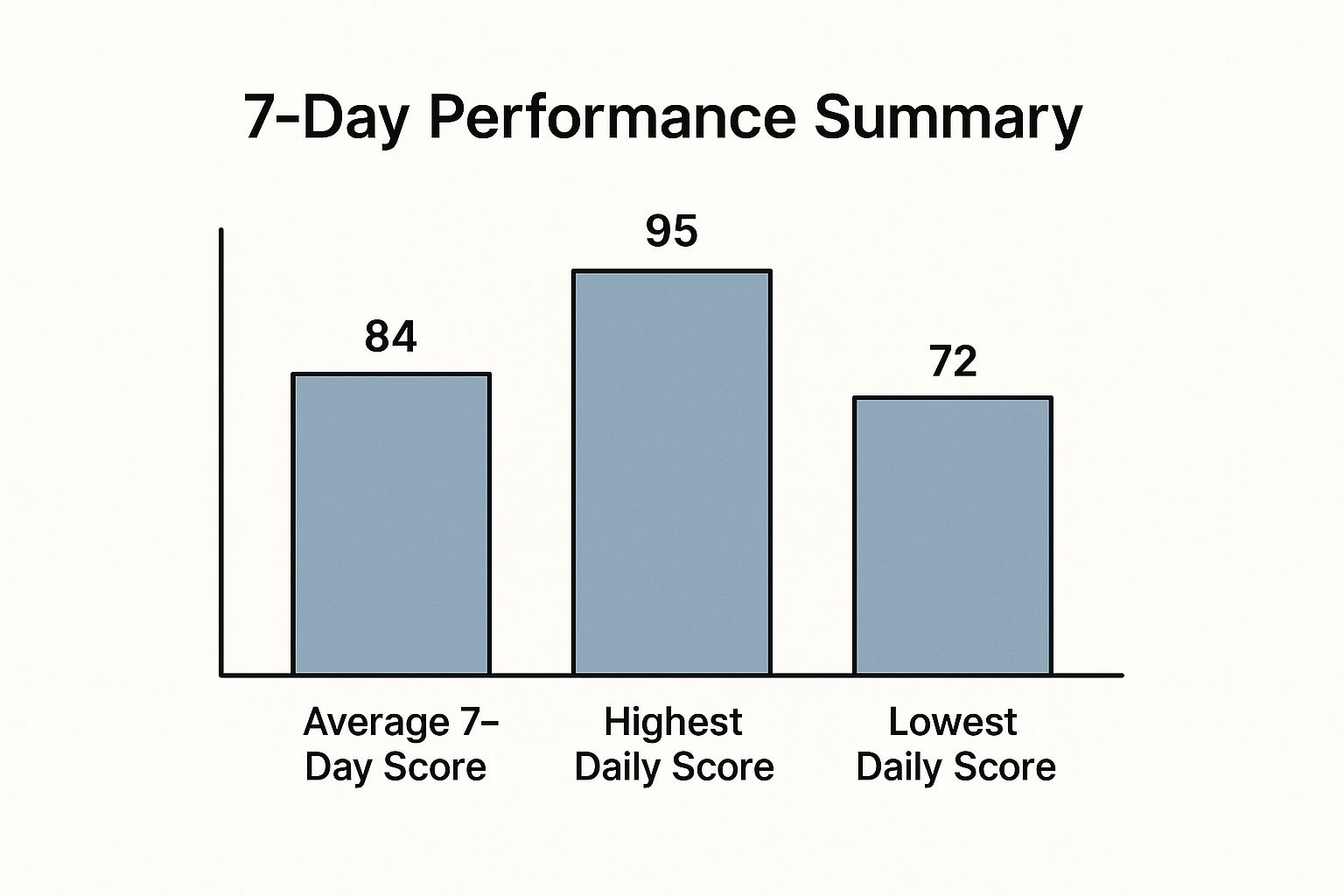

The infographic above provides a snapshot of a 7-Day Performance Summary. It compares the average score over the week with the highest and lowest daily scores. While daily performance can fluctuate significantly, the 7-day trend offers a more comprehensive view. This allows investors to look beyond short-term market volatility and assess performance more effectively.

Understanding the factors that influence these weekly trends is crucial for successful investing on LuckyTurbo. One significant driver is the Bank of England’s announcements. Their decisions, especially concerning interest rates, can create ripples across the market, leading to predictable weekly patterns.

Impact of Corporate Earnings and Global Events

Corporate earnings reports also tend to concentrate around specific weekdays, creating potential opportunities. By tracking 7-day performance, traders can anticipate market reactions to these releases. This is particularly relevant for the UK market, where the FTSE 100‘s composition can amplify the impact of sector-specific earnings. Analyzing the FTSE 100’s performance can reveal insights into the relative strengths and weaknesses of various sectors. For example, in the first quarter of 2025, the FTSE 100 outperformed the FTSE 250, largely driven by robust performance in defensive sectors like energy. Banks, along with the oil, gas, and coal sector, were key contributors, returning 6.11% and 2.14% respectively. For a deeper dive into these figures, you can refer to the FTSE 100 Q1 2025 Performance report.

International events also play a key role in shaping market dynamics. Global events can have a distinct impact on FTSE assets compared to their European counterparts, creating both opportunities and challenges within 7-day periods. For more insights on related topics, you can explore Our Sitemap.

Leveraging Market Sentiment For 7 Days Performance

The interplay between institutional investors and retail investor sentiment significantly influences weekly trading activity. Large institutions often rebalance their portfolios based on weekly trends, while retail investors react to news and prevailing market sentiment. Understanding these dynamics can help anticipate market shifts and potentially capitalize on 7-day performance trends on LuckyTurbo. Recognizing these hidden drivers allows you to move from reactive to proactive, positioning yourself for greater success. Understanding SEO cost UK can also be valuable for effective budget allocation.

To further clarify the various factors at play, let’s examine the following table:

The following table, “7-Day UK Market Performance Drivers,” outlines the critical factors influencing weekly market movements and their relative impact. This table aims to provide a clear overview of the key drivers and their respective characteristics.

| Factor Type | Typical Impact Level | Response Time | Examples |

|---|---|---|---|

| Bank of England Announcements | High | Immediate to Short-Term (1-3 days) | Interest rate decisions, Quantitative Easing announcements |

| Corporate Earnings | Medium | Short-Term (1-2 days) | Earnings reports from FTSE 100 companies |

| Global Events | Variable (Low to High) | Short to Medium-Term (1-5 days) | Geopolitical events, major economic news |

| Market Sentiment | Medium | Short-Term (1-3 days) | News headlines, social media trends, investor confidence |

This table summarizes the key drivers impacting the UK market’s 7-day performance. Understanding these drivers and their typical impact can help investors develop more informed strategies. By considering these factors, investors can move beyond simply reacting to market changes and begin to anticipate potential shifts, improving their chances of success on LuckyTurbo.

Sector Rotation Mastery: 7 Days Performance Signals

Analyzing market trends is crucial for strategic investing. The 7 days performance window offers valuable insights, striking a balance between daily noise and longer-term monthly data. This timeframe allows investors to spot emerging trends and potential opportunities within the UK market.

Identifying Sector Leaders and Laggards

Using 7 days performance is particularly helpful for identifying leading and lagging sectors within the FTSE 100. For example, during economic uncertainty, defensive sectors like utilities and consumer staples may show more consistent 7 days performance than cyclical sectors like financials or industrials.

Conversely, during economic growth, cyclical sectors could outperform. Recognizing these patterns informs smarter investment decisions on LuckyTurbo.

Practical Techniques For Sector Allocation on LuckyTurbo

Understanding weekly sector performance can help LuckyTurbo participants refine their competition strategies. This knowledge can influence prize selections, aligning choices with sectors demonstrating strong 7-day momentum.

For example, if the technology sector consistently gains over several 7-day periods, participants might choose tech-related prizes. This strategic approach shifts from luck-based to informed decision-making.

The Interplay of News, Economics, and Technical Signals

Several factors influence 7 days sector performance. Industry-specific news can have an immediate impact. For instance, positive news about a new tech product launch could boost tech stock performance over 7 days.

Economic data releases, such as GDP growth or inflation figures, also play a significant role. These macro factors influence overall market sentiment, impacting different sectors uniquely.

Technical signals offer further insights. Analyzing chart patterns and momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can reveal sector-specific opportunities. Recognizing these patterns helps determine if a sector’s 7-day momentum is sustainable.

Defensive vs. Cyclical Sectors: Weekly Performance Dynamics

Understanding the difference between defensive and cyclical sectors is key to interpreting 7 days performance. Defensive sectors, like utilities and consumer staples, tend to exhibit stable weekly performance regardless of the broader economic climate due to consistent demand for essential goods and services.

Cyclical sectors, like financials and industrials, are more sensitive to economic shifts. Their 7 days performance often reflects changes in economic sentiment.

Recognizing these characteristics is vital for effective sector rotation on LuckyTurbo. Observing the 7 days performance of defensive sectors relative to cyclical sectors offers insights into broader market trends and informs allocation decisions, potentially improving success on LuckyTurbo.

Technical Analysis That Works: 7 Days Performance Edition

Generic technical analysis often misses the mark when applied to the UK market’s unique 7-day performance trends. Simply relying on standard indicators without adjusting them for the shorter timeframe can be ineffective. This section provides the tools and techniques needed to analyze and predict weekly British equity movements, crucial for informed decisions on LuckyTurbo.

Adapting Momentum Indicators for 7 Days Performance

Traditional momentum indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can be very useful, but they need tweaking for 7-day periods. A standard 14-day RSI, for example, might be too slow to react to rapid shifts within a week. Switching to a 7-day, or even a 5-day RSI, delivers more responsive signals for weekly trends in FTSE components.

This shorter timeframe allows for more accurate identification of overbought or oversold conditions within the weekly cycle. Furthermore, adjusting the MACD settings, such as using shorter-term moving averages, can heighten its sensitivity to weekly price fluctuations.

Identifying Key Candlestick Formations

Candlestick patterns offer valuable visual clues about potential price action. Specific formations within a 7-day window, such as bullish engulfing or piercing patterns, can suggest impending upward trends. On the other hand, bearish engulfing or dark cloud cover patterns may hint at potential declines.

Recognizing these formations alongside momentum indicators provides valuable confirmation. A bullish engulfing pattern combined with a rising RSI, for instance, could signal a strong buy signal for the coming week.

Understanding Volume Dynamics

Trading volume offers important insight into the strength of price movements. High volume during a price increase indicates strong buying pressure. Low volume during a price decrease suggests a lack of selling conviction. Volume analysis, therefore, helps distinguish between real trends and short-lived blips.

Analyzing volume over 7-day periods is particularly revealing. Consistently rising volume over several weeks, even with minimal price changes, could point to growing institutional interest. This might foreshadow a potential breakout.

The Importance of Dividends and Buybacks in the UK Market

Dividends and share buybacks have significantly impacted the UK market’s 7-day performance, especially in 2025. UK companies, known for their generous dividend yields, often influence short-term price movements. The FTSE All-Share index’s average dividend yield of roughly 4% significantly outpaces the S&P 500’s average. Moreover, buyback yields in the UK have also climbed, bringing the FTSE All-Share’s effective cash yield to nearly 6%. Find more detailed statistics here: JPMorgan Asset Management.

This heightened buyback activity implies that company executives believe their shares are undervalued, which often boosts short-term stock prices, frequently reflected in 7-day performance data. This, coupled with increasing merger and acquisition activity, adds further upward pressure on prices. By examining dividend and buyback trends, LuckyTurbo participants can sharpen their weekly performance assessments and pinpoint potential investment opportunities. Integrating these technical tools creates a robust framework for analyzing 7-day performance in the UK market, helping filter out noise and uncover profitable opportunities.

Building Your Ultimate 7 Days Performance Dashboard

A well-structured performance dashboard is your command center for tracking weekly progress and spotting emerging trends in the UK market. This guide will help you build a personalized dashboard to unlock valuable 7-day performance insights, giving you an advantage on LuckyTurbo.

Selecting Key Metrics For Your Dashboard

First, identify the metrics that truly matter for your 7-day performance. Instead of getting lost in a sea of data, focus on the indicators that offer predictive power for UK market movements.

- FTSE 100 Sector Rotation Velocity: This measures how quickly money is flowing between sectors within the FTSE 100 over a 7-day period. Rapid shifts can indicate emerging trends or sector-specific opportunities.

- UK Market Sentiment Divergence: Track the difference between professional and retail investor sentiment. Divergences can highlight potential turning points in the market.

- 7-Day Moving Average of Key FTSE 100 Components: Monitor the weekly trends of influential stocks within the index to gauge overall market direction.

Choosing The Right Tools

Several tools, both premium and free, can help you track weekly performance.

- Premium Platforms (e.g., Bloomberg Terminal): Offer comprehensive data, advanced charting, and real-time alerts. These are valuable for serious investors.

- Free Resources (e.g., Yahoo Finance, Google Finance): Provide basic charting and data for tracking key metrics. These are great for beginners.

Setting Up Your Dashboard: A Step-by-Step Guide

Here’s how to build your 7 days performance dashboard:

- Choose Your Platform: Select a platform that fits your needs and budget.

- Input Your Metrics: Add the selected metrics to your dashboard.

- Set Alert Thresholds: Based on historical 7-day data, set meaningful alert levels. This will notify you of significant changes. For example, if the FTSE 100 Sector Rotation Velocity exceeds a certain threshold, you’ll receive an alert.

- Visualise the Data: Charts and graphs make it easier to interpret data and spot trends quickly.

- Integrate into Your Routine: Regularly review your dashboard, preferably daily. Consistent monitoring is key to capturing opportunities.

Example Dashboard Setup

The table below, “Essential 7 Days Performance Metrics”, shows how a 7-day performance dashboard might be structured. It provides critical indicators for tracking weekly market movements in UK markets.

| Metric | What It Measures | Interpretation | Action Signal |

|---|---|---|---|

| FTSE 100 Sector Rotation Velocity | Speed of fund flows between FTSE 100 sectors | High velocity indicates potential sector shifts | Investigate sectors with significant inflows |

| UK Market Sentiment Divergence | Difference between professional and retail investor sentiment | Large divergences can signal market turning points | Consider contrarian trades if retail sentiment is excessively bullish or bearish |

| 7-Day Moving Average of Key FTSE 100 Components | Weekly trend of influential FTSE 100 stocks | Upward trend suggests positive momentum; downward trend suggests negative momentum | Adjust portfolio allocations accordingly |

This table highlights how combining these metrics can give you a comprehensive view of the market. By tracking these key indicators, you can potentially identify emerging trends and react accordingly.

By following these steps, you can create a powerful dashboard that provides actionable 7-day performance insights. This empowers you to make informed decisions on LuckyTurbo, increasing your success in online competitions.

7 Days Performance Strategies That Actually Deliver

This section dives into proven trading strategies tailored for the UK’s 7-day market cycle. Whether you’re a day trader at LuckyTurbo or a long-term investor, these strategies provide a structured approach to improving your performance. You might also be interested in: Our Winner Sitemap.

Strategy 1: The FTSE 100 Weekly Momentum Play

This strategy uses short-term momentum within the FTSE 100.

- Entry Criteria: Look for FTSE 100 components with a consistent upward trend over the past 5 days, confirmed by a 7-day Relative Strength Index (RSI) above 70.

- Exit Criteria: Close the position when the 7-day RSI drops below 50, or if the stock price falls below its 5-day moving average.

- Position Sizing: Risk no more than 2% of your capital on any single position.

- Protective Measures: A stop-loss order placed just below the 5-day moving average can help limit potential losses.

Strategy 2: The Sector Rotation Edge

This strategy takes advantage of rotating sector performance within the FTSE 100 over a 7-day period. Using Exchange Traded Funds (ETFs) can be a great way to track sectors.

- Entry Criteria: Find sectors showing increasing relative strength compared to the FTSE 100 over the last 3 to 5 days.

- Exit Criteria: Exit when the sector’s relative strength declines or if the overall market weakens.

- Position Sizing: Limit sector exposure to 3% of your capital.

- Protective Measures: Diversifying across multiple strong sectors helps mitigate risk.

Strategy 3: The 7-Day Contrarian Approach

This strategy aims to identify short-term trend reversals.

- Entry Criteria: Look for FTSE 100 components with a sharp decline over 3 to 5 days and oversold conditions (7-day RSI below 30).

- Exit Criteria: Exit when the stock price recovers to its previous 7-day high or when the RSI climbs above 50.

- Position Sizing: Limit positions to 1% of your capital due to the higher risk.

- Protective Measures: A stop-loss order placed below the recent low helps control potential losses.

Adapting to Market Conditions and UK Specificities

These strategies need to be adjusted based on current market conditions and UK-specific factors. Tracking key metrics is important for an effective 7-day performance dashboard. You can learn more about relevant metrics through resources like articles on Campaign Performance Metrics.

- Volatility: During high volatility, tighten stop-loss orders and reduce position sizes.

- Economic Transitions: Monitor economic indicators like the Bank of England’s interest rate decisions and adjust accordingly.

- Currency Movements: Changes in the British Pound can impact UK-listed multinational companies.

- Domestic Policy Shifts: Government policy changes can affect specific sectors. Stay informed and adapt.

Real-World Examples and Performance Analysis

Backtesting these strategies against historical FTSE 100 data shows their potential and limitations. For instance, the Weekly Momentum Play often performs well in strong uptrends but can falter during downturns. Sector Rotation offers more consistent returns but requires monitoring sector-specific news and data. The Contrarian Approach has higher potential returns but also carries greater risk.

Understanding each strategy’s strengths and weaknesses, and adapting to the current market, can improve your chances of success when participating in Lucky Turbo Competitions.