Navigating the UK Prize Money Tax Landscape

Winning a prize, whether a modest pub quiz reward or a life-changing lottery jackpot, is undoubtedly exciting. However, understanding the UK tax implications on your winnings is essential for managing your finances effectively. This guide breaks down the basics of how Her Majesty’s Revenue and Customs (HMRC) treats prize money.

Understanding Taxable and Non-Taxable Prizes

The first step is distinguishing between taxable and non-taxable prizes. Generally, prize money is treated as income and is therefore taxable. This means your winnings are added to your annual income and taxed according to your tax bracket.

However, there are notable exceptions. Winnings from the National Lottery are famously tax-free, allowing winners to retain their entire prize. This is a significant advantage for lottery players. For those interested in increasing their chances, check out this guide on how to win competitions.

Additionally, smaller prizes from amateur competitions or certain academic awards may also be exempt. Always verify the specific rules, as these exemptions can significantly impact your final payout. Careful planning is vital. For insightful tips on long-term financial planning, explore these retirement tax strategies.

Tax Implications for UK Residents vs. International Winners

Tax rules for prize money differ between UK residents and international winners. For UK residents, standard income tax regulations apply, with winnings added to their total yearly income. The situation is more nuanced for international winners.

The UK taxes prize money earned within its borders, including winnings from prestigious events like Wimbledon. International competitors, regardless of residency, are subject to UK tax on their UK earnings.

For example, a tennis player winning £1 million at Wimbledon would face UK income tax on that sum. The precise rate depends on their UK income and residency status, but it usually falls under the basic rate of 20% or higher for larger incomes. This contributes to the UK’s overall tax receipts, projected to be around £1,099 billion for 2023-24. For non-resident athletes, calculating taxable UK income involves apportioning worldwide endorsement income based on days spent performing in the UK, using methods like Relevant Performance Days (RPD) or Relevant Performance and Training Days (RPTD). For a more in-depth look, explore this article on international performers and UK income tax.

Understanding these differences is crucial for anyone participating in UK-based competitions or lotteries. Planning and awareness of tax implications help you make informed decisions and avoid surprises after a big win.

Breaking Down Tax Rates on Your Prize Winnings

Winning big with Lucky Turbo Competitions is exhilarating, but it’s essential to understand the tax implications. How much will HMRC take? This depends on the prize amount and your current income. Prize money in the UK is taxed as income, meaning your winnings are added to your other income and taxed accordingly.

Understanding UK Tax Brackets and Prize Money

The UK uses a progressive tax system. This means higher earners pay a larger percentage of their income in tax. This system directly impacts how prize money is taxed. Your winnings are taxed based on the bracket you fall into after the prize is added to your income.

For instance, if you win £5,000 and you’re already in the basic rate band, that £5,000 is also taxed at 20%. But, if the win pushes you into a higher band, some of the prize will be taxed at 40%.

Examples of Tax Calculations

Here are a few examples:

- £5,000 Win: With an existing income of £20,000, a £5,000 win will likely keep you in the basic rate band, resulting in a tax bill of about £1,000.

- £50,000 Win: This larger win is more likely to push you into a higher bracket. If your income is £30,000, part of the prize will be taxed at 20% and the rest potentially at 40%, leading to a much higher tax bill.

- £500,000 Win: A win this size will likely put a significant portion of your winnings into the highest rate bands (40% or even 45%). Careful tax planning becomes crucial here. Navigating prize money taxes can be tricky, especially with potential deductions. See our guide on Gambling Losses Taxes Deductions.

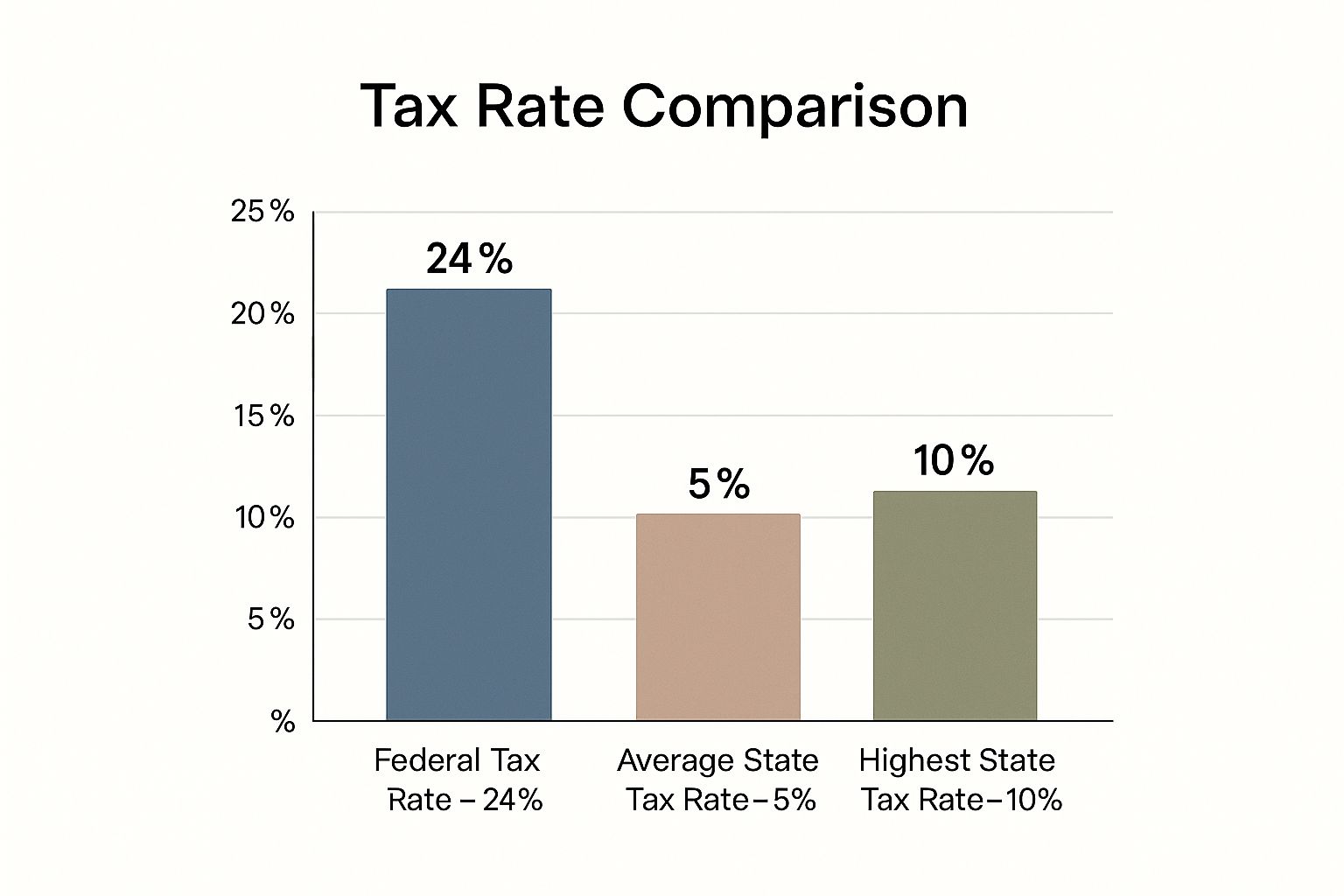

The infographic above simplifies potential tax rates. Combined federal, average state, and highest state tax rates significantly impact overall taxes on winnings. It highlights the importance of understanding your specific state’s tax rates.

To further illustrate the current tax rates applicable to prize winnings, let’s look at a detailed table:

UK Income Tax Rates Applied to Prize Money

A comprehensive breakdown of the different tax bands and rates that apply to prize money in the UK

| Tax Band | Income Range | Tax Rate | Tax Due on Prize Money Example |

|---|---|---|---|

| Personal Allowance | Up to £12,570 | 0% | £0 |

| Basic Rate | £12,571 to £50,270 | 20% | (Prize amount within this range) x 0.20 |

| Higher Rate | £50,271 to £125,140 | 40% | (Prize amount within this range) x 0.40 |

| Additional Rate | Over £125,140 | 45% | (Prize amount within this range) x 0.45 |

This table is a simplified representation for illustrative purposes. Actual tax calculations can be more complex depending on individual circumstances.

This table clearly shows how different portions of prize money might be taxed at different rates depending on the total taxable income. It’s crucial to remember your total income (including the prize) determines which tax bands apply.

The Evolving Landscape of UK Tax Law

UK tax laws can change. Historically, UK tax policies have evolved, affecting how income, including prizes, is taxed. The top income tax rate was 50% in 2010, reverting to 45% in 2013. These changes show the UK tax system’s dynamic nature. Learn more about UK taxation. Staying aware of current regulations is essential. Understanding these principles helps you plan for your tax obligations and enjoy your winnings.

International Athletes and the UK Prize Money Tax Web

For international athletes, competing in the UK presents unique tax challenges when it comes to prize money. These considerations extend beyond just the winnings; they impact an athlete’s global financial strategy.

UK Taxes and International Athletes: A Balancing Act

The UK taxes all prize money earned within its borders. This applies regardless of where the winner resides. Even iconic events like Wimbledon are subject to these rules, requiring international athletes to understand the UK tax system. This approach allows the UK to benefit from hosting prestigious events while striving to maintain a competitive landscape for attracting top athletic talent.

Endorsements and the Taxman: A Complex Equation

The tax implications extend beyond prize money. A crucial factor for international athletes is the taxation of endorsement income. A portion of an athlete’s global endorsement income is taxable in the UK. This is based on the number of days they compete or train within the country.

The calculation often uses methods like Relevant Performance Days (RPD) or Relevant Performance and Training Days (RPTD). An athlete with a substantial endorsement deal could face a higher tax bill if they spend a significant amount of time competing in the UK.

Strategic Tax Management: Navigating the Complexities

This complex system can be a deterrent for some athletes. Historically, some have even bypassed UK competitions due to the tax ramifications. However, many top athletes and their advisors use strategic planning to manage their tax liability. This can involve careful scheduling of competitions, structuring endorsement agreements, and exploring other legal tax optimization strategies.

Real-World Examples: Understanding the Impact

Consider a hypothetical scenario: a tennis player wins £200,000 at a UK tournament. They will owe taxes on the prize money, potentially at the higher rate of 40% if their total UK income surpasses £50,270. Additionally, a portion of their endorsement income will also be taxed in the UK. This combined tax burden highlights the need for proactive tax planning.

Understanding UK prize money tax laws is essential for international athletes. This knowledge affects not only their immediate earnings but also their long-term financial health and career choices. Careful consideration of these factors is key to maximizing net income.

Prize Money You Might Not Have to Share With HMRC

Winning a prize is exciting, but it’s essential to understand the tax implications. While prize money is generally taxable in the UK, some welcome exceptions exist. Let’s explore these scenarios where you might not have to hand over a portion of your winnings to HMRC.

Exempt Winnings: When You Can Keep It All

Certain prizes are entirely tax-free. A prime example is winnings from the National Lottery. Scooping the jackpot means you won’t pay income tax on your windfall, leaving you with a significantly larger sum. Remember, however, that other taxes, like inheritance tax, might still apply.

Amateur competition prizes and certain academic or cultural achievement awards can also be tax-exempt. Imagine winning a local photography contest or receiving a scholarship – you might be able to keep the entire amount. Always verify the competition’s terms and conditions to understand the specific tax implications.

Reducing Your Tax Burden: Legitimate Relief Strategies

Even when prize money is taxable, you can take steps to lessen the impact. This involves exploring legitimate tax relief measures. One effective strategy is making charitable donations. By donating a portion of your winnings to a registered charity, you can potentially reduce your tax liability.

Another option is contributing to a pension plan. Pension contributions can reduce your taxable income, potentially lowering your tax bill on prize winnings. Plus, you’re also investing in your future financial security. Additionally, if you incurred expenses directly related to winning the prize, such as travel costs for a competition, you might be able to deduct those expenses from your taxable income.

Specific Tax-Free Examples

Here’s a breakdown of common tax-free prize scenarios:

- Amateur Competitions: Prizes from small-scale local competitions, like a village raffle or a local sports club award, are often tax-free.

- Academic and Cultural Awards: Some scholarships, bursaries, and awards for artistic or cultural achievements might be exempt. These usually have specific criteria related to the award’s purpose.

- National Lottery: As mentioned, UK National Lottery winnings are free from Income Tax.

Here’s a table summarizing these exemptions:

| Type of Prize | Tax Status | Considerations |

|---|---|---|

| National Lottery Winnings | Tax-Free (Income Tax) | Potential Inheritance Tax implications |

| Amateur Competition Prizes | Often Tax-Free | Depends on the scale and nature of the competition |

| Academic/Cultural Awards | Potentially Tax-Free | Specific criteria related to the award’s purpose |

Understanding potential tax exemptions and relief strategies is a crucial first step. However, given the complexities of UK tax law, consulting with a tax advisor is always recommended. They can provide personalized guidance on your specific tax obligations and help you explore strategies to legally minimize your tax liability. This ensures you retain as much of your prize as possible while remaining compliant with the law.

From Winning to Reporting: Your HMRC Compliance Guide

Winning a competition is exhilarating! But understanding your tax obligations can save you from potential issues later. This guide helps you understand HMRC compliance for prize winnings in the UK. We’ll cover when and how to declare your winnings, the required forms, and important deadlines. This ensures you can enjoy your prize without any unexpected tax surprises. For those interested in instant wins, check out: Instant Win Competitions.

When To Declare Your Winnings

Knowing when to report prize money to HMRC is essential. Prize money is generally considered income. This means it’s added to your other earnings for the tax year it was received. This impacts your tax liability depending on your tax band. This approach aligns with how the UK taxes other income sources. Prize money from UK events is subject to income tax. The broader UK tax landscape also includes duties on betting and gaming. These don’t directly apply to prize winnings, but they highlight the complexity of the UK tax system. For example, General Betting Duty rates have seen fluctuations, including a rise from 6.75% to 15% in 2001. These adjustments reflect efforts to manage tax revenue from various sectors, including those related to prizes, like betting and gaming. For a deeper dive, explore: Historical UK Betting and Gaming Duty Rates. Companies like Betfair pay taxes on their betting revenues, separate from taxes on individual prize winnings. The UK tax system for prize money itself mainly focuses on income tax, a major source of government revenue. Some small prizes or winnings from specific competitions, like the National Lottery, might be exempt.

How To Declare Your Winnings: A Step-by-Step Guide

Declaring prize winnings is a straightforward process. Follow these steps:

- Gather Your Documents: Collect all relevant paperwork, including prize notifications, competition rules, and bank statements showing the prize deposit.

- Complete the Self Assessment Tax Return: If you’re self-employed or have multiple income streams, report prize money through a Self Assessment tax return. This form requires details of all your income, including the prize amount and its source.

- Inform HMRC Through Other Channels: If you’re employed and pay tax through PAYE, you can inform HMRC about your winnings via their helpline or in writing. They will advise on adjusting your tax code or making payments.

Important Deadlines and Record Keeping

Meeting deadlines is crucial for compliance. Self Assessment tax returns are usually due by 31 January after the tax year ends. Missing this can result in penalties. Keeping accurate records is equally vital. Retain copies of all prize-related documents for at least five years. This enables you to address HMRC inquiries and verify your reported income. By understanding HMRC rules and maintaining good records, you’ll ensure a smooth tax process for your prize winnings.

Strategic Planning for Prize Money Tax Optimization

Winning a substantial prize is a thrilling experience, but navigating the tax implications is essential to truly maximizing your windfall. This isn’t just about meeting your obligations to HMRC; it’s about proactively planning to optimize your tax position and keep more of your winnings.

Timing Is Everything: Income Recognition and Tax Years

A key strategy involves carefully timing your income recognition. This means strategically choosing when you receive your winnings to potentially minimize your tax liability. For example, if you expect a significant income increase next tax year, delaying receipt of your prize money could prevent it from being taxed at a higher rate. This is particularly relevant for winnings that push you into a higher tax bracket. Spreading income across different tax years, known as cross-tax-year planning, offers valuable opportunities for optimizing your overall tax burden. For more insights, check out this article: How to master taxes on your winnings.

Structuring Your Affairs: Companies and Recurring Wins

For consistent prize winners, establishing a limited company can be a strategic move. This structure offers more control over how winnings are managed and potentially provides access to different tax benefits. A company can offer greater flexibility in how income is distributed and taxed. However, it’s crucial to weigh the administrative costs and complexities of running a company against the potential tax advantages. Consulting with a financial advisor is essential to determine if this is the right strategy for your situation.

Leveraging Allowances and Reliefs: Minimizing Your Tax Bill

Understanding and utilizing available allowances and reliefs is fundamental to prize money tax optimization. The UK tax system offers various ways to reduce your tax bill. For instance, charitable donations can offset a portion of your taxable income. Similarly, contributing to a pension scheme offers tax relief while building a secure financial future. Carefully exploring these options can significantly impact your after-tax winnings.

Legal Optimization vs. Tax Avoidance: Staying Within HMRC’s Framework

Optimizing your tax position is perfectly legitimate, but it’s vital to distinguish between legal optimization and tax avoidance. The goal is to minimize your tax liability within HMRC regulations, not to evade your responsibilities. Aggressive tax avoidance schemes can result in severe penalties. Working with a qualified tax advisor ensures your strategies are both effective and compliant.

Tailored Strategies for Different Prizes: Maximizing Your Returns

Different prize types often call for different tax planning approaches. Managing a large lottery win requires a different strategy than handling recurring winnings from smaller competitions. The prize value, frequency, and source all influence the most effective tax optimization strategy. A tailored approach is crucial for the best outcome.

To illustrate the different approaches, let’s look at a comparison table:

Prize Money Tax Planning Comparison

Comparison of different tax planning approaches for various types and amounts of prize money

| Strategy | Best For | Potential Tax Savings | Implementation Complexity | Professional Help Required |

|---|---|---|---|---|

| Timing Income Recognition | Prizes near tax bracket thresholds | Moderate | Low | Recommended |

| Establishing a Company | Recurring large prize winners | High | High | Essential |

| Leveraging Allowances & Reliefs | All prize winners | Moderate | Low to Moderate | Recommended |

This table summarizes how different strategies can be applied depending on individual circumstances. While timing income recognition offers moderate savings with low complexity, establishing a company can yield higher savings but involves higher complexity. Leveraging allowances and reliefs is generally recommended for all prize winners. Consulting with a professional is always advisable for complex situations.

Ready to take control of your prize winnings and maximize your after-tax income? Visit Lucky Turbo Competitions today!