Fast Cash in a Flash: Your 2025 Guide

Need instant cash? This guide reveals eight ways to get funds quickly in the UK. From gig work and online selling to cashback rewards and crypto trading, discover methods to boost your income or access funds fast. We'll cover peer-to-peer lending, cash advance apps, asset-based loans, and quick service opportunities. Compare each option's pros and cons to find the best solution for your financial needs. Get the instant cash you need now!

1. Gig Economy and Freelancing Platforms

Need instant cash? The gig economy and freelancing platforms offer a powerful solution, connecting individuals with clients seeking immediate services. These digital marketplaces empower you to monetize your existing skills – whether it's writing, graphic design, programming, or even offering services like furniture assembly or deliveries – often with same-day or next-day payment options. This makes them an ideal choice for anyone seeking quick access to funds.

These platforms operate on a simple principle: matching freelancers with clients based on skills and project requirements. You create a profile, highlighting your expertise and experience, and then browse available gigs or respond to client requests. Once a job is completed and approved, payment is processed, often with the option for instant withdrawals. This ease of access to instant cash is a major draw, especially for those facing unexpected expenses or seeking supplemental income.

The beauty of this approach lies in its flexibility and low barrier to entry. You can set your own hours, work from anywhere with an internet connection, and choose projects that align with your skills and interests. Fancy earning extra cash while streaming your favourite game? Write blog posts about it, create graphics for other streamers, or even offer coaching services. Need to upgrade your tech setup? Take on a few quick writing gigs or design some logos. The possibilities are vast. Imagine a scenario: an Uber driver in London completes several rides during peak hours and cashes out £50-£75 instantly to cover a last-minute concert ticket. Or a freelance writer, leveraging their gaming knowledge, crafts a compelling review of the latest RPG and receives £100 the same day. This accessibility to instant cash makes gig work a viable option for those within the gaming and tech enthusiast communities.

Here are some actionable tips to maximize your earnings in the gig economy:

- Optimize Your Profile: Showcase your skills and experience with a compelling profile and portfolio. Include samples of your work, testimonials, and any relevant certifications.

- Target High-Demand Services: Initially, focus on services with quick turnaround times and high demand. This can help you gain experience, build your reputation, and generate income quickly. Think short articles, social media graphics, or quick coding tasks.

- Competitive Pricing: Research market rates and set competitive prices, especially when starting. As you gain positive reviews and build your reputation, you can gradually increase your rates.

- Leverage Instant Payout Features: Take advantage of platforms that offer instant payout options to access your earnings immediately.

- Consistent Communication and Deadlines: Maintain clear communication with clients, respond promptly to inquiries, and meet deadlines religiously. This builds trust and leads to repeat business.

While the gig economy offers significant advantages, it’s crucial to be aware of the potential downsides. Platform fees can range from 5-20% of your earnings, income can be unpredictable, and you won’t receive traditional employment benefits like holiday pay or sick leave. Competition can also be fierce, particularly in popular categories. Building a solid reputation and a strong client base requires time and effort.

The gig economy, popularized by platforms like Uber (Travis Kalanick and Garrett Camp), Fiverr (Micha Kaufman and Shai Wininger), and TaskRabbit (Leah Busque), represents a significant shift in how work is done. For those seeking instant cash, the ability to leverage existing skills, set their own hours, and access funds quickly makes this a compelling option. While it requires dedication and strategic planning, the potential for income generation and flexibility is undeniable, especially for the tech-savvy individuals within the online gaming and enthusiast communities.

2. Online Selling and E-commerce Flipping

Need instant cash? Online selling and e-commerce flipping might be the perfect solution. This entrepreneurial approach involves buying and reselling items online for profit, capitalising on price discrepancies between platforms, geographical locations, or through shrewd market timing. Whether you're selling personal belongings, engaging in retail arbitrage, or sourcing products specifically for resale, e-commerce flipping offers a path to generating quick cash flow. It’s a particularly appealing method for tech and gadget fans, gamers looking to upgrade their setup, or anyone comfortable navigating online marketplaces. Imagine turning that limited-edition console gathering dust into a wad of cash or finally profiting from your expert knowledge of vintage video games. That's the power of e-commerce flipping.

This method stands out because it’s scalable. You can begin small, perhaps by selling unused electronics on eBay, and grow it into a full-fledged business over time. You're in control, setting your own pace and choosing product categories that align with your interests, whether it’s retro gaming consoles, limited edition sneakers, or even furniture. This flexibility makes it ideal for online gaming enthusiasts, prize seekers with an eye for value, and anyone with a passion for specific product niches.

The potential for diverse revenue streams is a significant advantage. You can operate across numerous platforms, like eBay, Amazon, Facebook Marketplace, Depop, and Vinted, diversifying your reach and maximizing your chances of making a sale. Imagine selling a rare gaming collectible on a specialist forum while simultaneously offloading vintage clothing on Depop – that’s the beauty of multi-platform selling.

Modern e-commerce tools further empower you. Multiple platform integration allows you to manage listings across different marketplaces efficiently. Price comparison tools and market analysis software can help you identify profitable opportunities and price your items competitively. Fast payment processing through digital wallets like PayPal and Stripe ensures quick access to your earnings – often the very definition of "instant cash." Mobile-first selling apps enable you to list items on the go, turning even your commute into a potential money-making opportunity. Finally, integrated shipping and logistics support streamline the process of getting your sold items to their new owners.

However, it’s important to be aware of the potential downsides. Starting typically requires some capital for initial inventory, although you can minimize this by beginning with items you already own. Market saturation can be an issue in popular product categories, making competitive pricing and unique product sourcing crucial. Platform fees and shipping costs can also eat into your profit margins, so careful calculation is essential. Finally, the process of researching, listing, and managing inventory can be time-consuming, especially as your operations scale.

Examples of E-commerce Flipping Success in the UK:

- Clearing £400+ monthly selling unused electronics and gaming accessories on eBay.

- Retail arbitrage earning £150-750 weekly buying clearance items from UK retailers for Amazon FBA.

- Facebook Marketplace furniture flipping generating £250-600 per piece.

- Depop/Vinted closet cleanouts earning £40-200 per clothing lot.

Tips for Success:

- Research completed sales, not just current listings: This gives you a realistic understanding of market value.

- Start with categories you understand well: Your knowledge will give you an edge.

- Use professional photos and detailed descriptions: High-quality presentation attracts buyers.

- Price competitively but factor in all fees: Ensure you’re actually making a profit.

- Focus on high-turnover items initially: Build momentum and cash flow quickly.

- Utilize cross-platform listing tools for efficiency: Save time and expand your reach.

E-commerce flipping, inspired by online personalities like Gary Vaynerchuk (GaryVee), Ryan Kaji (retail arbitrage), and Raiken Profit (Amazon FBA), offers a viable path to instant cash, particularly for those comfortable with online platforms. While it demands effort and research, the potential for scalable income and the flexibility it offers make it an attractive option for many.

3. Cash Advance Apps and Earned Wage Access: Instant Cash at Your Fingertips

In today's fast-paced digital world, unexpected expenses can arise at any moment, leaving you scrambling for instant cash. For UK residents, cash advance apps and earned wage access (EWA) services offer a convenient and increasingly popular solution to bridge the financial gap between paydays. These mobile applications provide small cash advances against your future earnings or allow early access to wages you’ve already earned, providing a much-needed financial cushion without the hassle of traditional credit checks. This makes them a valuable tool for online gaming enthusiasts, prize seekers, tech and gadget fans, social media followers, and casual competitors who may need quick access to funds for tournament entries, new tech purchases, or other time-sensitive opportunities.

Cash advance apps and EWA services work by connecting to your bank account and verifying your employment and income. This allows them to assess your eligibility for an advance based on your earning history rather than your credit score. Once approved, you can typically receive the funds within minutes, directly deposited into your linked bank account. This speed and ease of access is a key reason why this method deserves its place on our list of instant cash options.

How it Works:

There are two primary models:

- Cash Advances: These apps provide a small advance, typically between £50 and £500, against your upcoming paycheck. You repay the advance, plus any fees, on your next payday.

- Earned Wage Access: These services allow you to access a portion of the wages you’ve already earned but haven’t yet been paid. You're essentially accessing your own money early.

Examples of Cash Advance and EWA Apps:

While some of the examples provided earlier are primarily US-based, similar services are emerging in the UK. It's important to research and compare available options. Some popular UK based options, or apps with UK availability, include:

- Wagestream: Wagestream partners with employers to offer earned wage access, allowing employees to access a portion of their already-earned wages.

- Hastee Pay: Another employer-integrated EWA provider, allowing access to earned wages before payday.

- FlexEarn: This app offers EWA and financial wellness tools, though availability may depend on your employer's participation.

(Please note that app availability and specific features may change. Always verify current information directly with the provider.)

Features and Benefits:

These apps offer a range of features designed for convenience and financial management:

- Instant Fund Transfer: Receive funds within minutes of approval.

- Bank Account Integration: Securely connect your bank account for automated verification and direct deposit.

- No Traditional Credit Checks: Access funds regardless of your credit history.

- Flexible Repayment: Repayment is typically aligned with your payroll cycle.

- Budgeting Tools: Some apps offer built-in budgeting and financial wellness features to help you manage your finances.

Pros and Cons:

Pros:

- Extremely Fast Access to Cash: Ideal for emergencies or time-sensitive opportunities.

- No Credit Score Requirements: Accessible to a wider range of individuals.

- Lower Fees than Traditional Payday Loans: A more affordable alternative to traditional short-term loans.

- Transparent Fee Structure: Most apps clearly outline their fees upfront.

Cons:

- Limited Advance Amounts: Advance amounts are typically smaller than traditional loans.

- Requires Steady Employment and Direct Deposit: Not suitable for freelancers or those without regular income.

- Potential for Dependency: Overuse can lead to a cycle of reliance on advances.

- Not Available for All Employment Types: Access may be limited based on your employer's participation.

- Potential for Fees: While generally lower than payday loans, fees can still accumulate.

Tips for Using Cash Advance Apps Responsibly:

- Compare Fee Structures: Research different apps to find the most competitive fees and terms.

- Use Sparingly: Avoid relying on advances as a regular source of income.

- Budget Carefully: Create a budget and track your spending to ensure you can repay the advance on time.

- Read the Terms and Conditions: Understand the repayment terms, fees, and any potential implications before using the service.

- Set Up Automatic Budgeting Features: Take advantage of any budgeting tools offered by the app to manage your finances.

Cash advance apps and EWA services can provide a valuable safety net for unexpected expenses or time-sensitive purchases. By using these services responsibly and understanding the associated fees and terms, you can leverage the power of instant cash while maintaining control of your financial well-being. For online gaming enthusiasts, prize seekers, and tech aficionados, these apps can be particularly useful for seizing opportunities that require quick access to funds. However, it’s crucial to remember that these apps are not a long-term financial solution and should be used judiciously.

4. Peer-to-Peer Lending and Borrowing

Need instant cash? Peer-to-peer (P2P) lending and borrowing platforms offer a modern alternative to traditional bank loans, connecting individuals who need to borrow money with those willing to lend it. By cutting out the financial middleman, these platforms leverage technology to assess creditworthiness and facilitate fast personal loans with competitive interest rates, often making them a viable option for securing funds quickly. This method is particularly attractive to those seeking instant cash due to its speed and accessibility, especially for those who might not qualify for traditional loans. It deserves a spot on this list because it provides a streamlined, technology-driven approach to borrowing, often delivering funds faster than traditional methods.

How it Works:

P2P lending platforms utilize sophisticated algorithms to evaluate borrowers' creditworthiness, considering factors like credit history, income, and debt-to-income ratio. This automated assessment allows for quicker loan decisions compared to traditional banks. Borrowers create profiles outlining their financial needs and desired loan terms. Lenders browse these profiles and choose which loans to fund, either partially or fully. Once a loan is fully funded, the funds are disbursed to the borrower, typically within 1-3 business days. The borrower then repays the loan with interest over the agreed-upon term.

Features and Benefits:

P2P lending offers several advantages:

- Speed: Automated credit decisions and online processes result in faster approvals and funding compared to traditional banks.

- Flexibility: Loan amounts and repayment terms are often more flexible, catering to various financial needs.

- Competitive Rates: Borrowers with good credit scores can often secure competitive interest rates.

- Transparency: Fee structures are generally transparent, with clear information on origination fees and other charges.

- Credit Building: Consistent, on-time repayments can positively impact your credit score.

Pros and Cons:

While P2P lending presents many benefits, it’s important to be aware of the potential drawbacks:

Pros:

- Faster approval than traditional bank loans

- More flexible credit requirements

- Competitive interest rates for good credit

- Transparent fee structure

- Can build credit with on-time payments

Cons:

- Higher rates than traditional banks for some borrowers

- Origination fees typically 1-8% of loan amount

- Still requires a credit check and verification

- Limited loan amounts for new borrowers

- Early repayment fees on some platforms

Examples in the UK:

While LendingClub, Prosper, Upstart, and SoFi primarily operate in the US, the UK has its own established P2P lending market. Platforms like Zopa, RateSetter (now part of Metro Bank), and Funding Circle offer similar services connecting borrowers and lenders. You can research these platforms to compare rates and loan terms available in the UK.

Tips for UK Borrowers:

- Compare Platforms: Shop around and compare rates, fees, and loan terms across different P2P platforms. Websites like MoneySuperMarket and Compare the Market can assist with this.

- Check Your Credit Score: Review your credit report before applying to understand your creditworthiness and potential interest rates. ClearScore and Experian are popular resources in the UK.

- Prepare Documentation: Have your income documentation, bank statements, and other necessary information ready to streamline the application process.

- Consider a Co-Signer: If you have a limited credit history or a lower credit score, a co-signer can improve your chances of approval and secure better rates.

- Calculate Total Cost: Factor in all fees, including origination fees and any potential early repayment fees, to calculate the total cost of the loan.

When to Use P2P Lending:

P2P lending can be a suitable option when you need a relatively small loan (£1,000-£50,000) and can wait a few days for funding (typically 1-7 business days). It's particularly attractive to borrowers who might struggle to obtain a loan from a traditional bank due to stricter lending criteria.

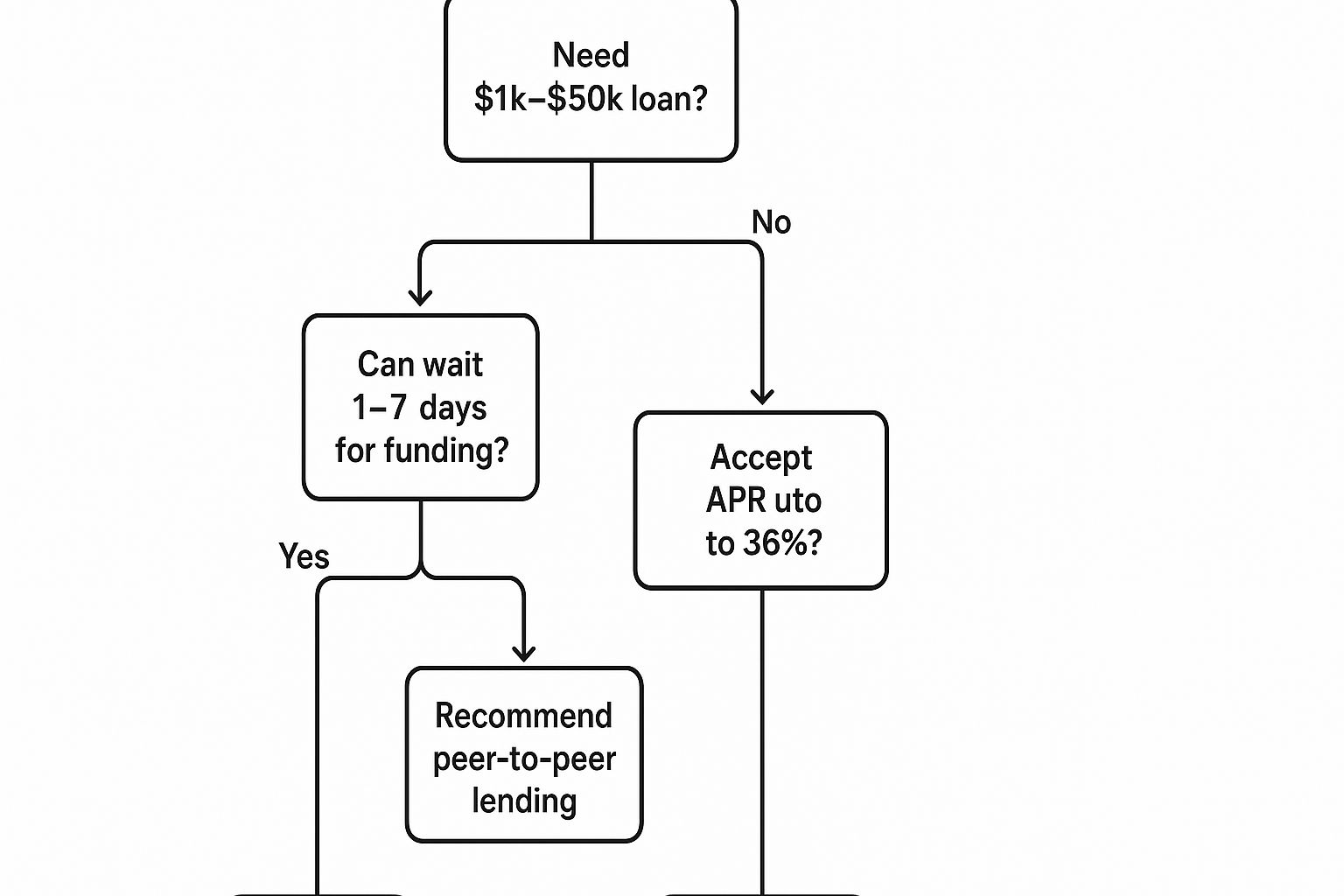

The following infographic provides a simple decision-making process for determining whether P2P lending is right for you. It visualizes the key criteria to consider before opting for this type of loan.

This infographic demonstrates that P2P lending is a good solution if you need a loan between £1,000 and £50,000, can wait a few days for funding, and are comfortable with potential APRs up to 36%. If any of these criteria aren't met, exploring alternative borrowing options is recommended.

5. Cryptocurrency and Digital Asset Trading

Cryptocurrency and digital asset trading offers a potentially rapid path to generating instant cash, albeit a high-risk one. This method involves buying, selling, and trading various cryptocurrencies and digital assets like Bitcoin, Ethereum, and numerous altcoins on various exchanges and platforms. The goal is to leverage market volatility, arbitrage opportunities, and diverse trading strategies to achieve quick returns on your investment. While it's not a guaranteed win, and significant losses are possible, the 24/7 nature of the crypto market combined with its inherent volatility creates numerous opportunities for savvy traders.

The cryptocurrency market operates around the clock, providing access to trading opportunities 24/7, unlike traditional stock markets. Major cryptocurrencies like Bitcoin and Ethereum boast high liquidity, meaning you can quickly buy and sell large amounts without significantly impacting the price. Furthermore, numerous exchanges offer a wide selection of trading pairs (e.g., BTC/GBP, ETH/USD) and advanced charting and analysis tools to help you make informed decisions. Many platforms also offer instant deposit and withdrawal options, further enhancing the "instant cash" potential. This makes it an attractive option for tech-savvy individuals, online gamers, and those comfortable with the fast-paced digital world.

This approach is particularly appealing to individuals seeking instant cash due to its speed and potential for high returns. For example, experienced day traders of Bitcoin report earning anywhere from £100 to £1000+ daily by capitalising on short-term price fluctuations, though this comes with substantial risk. Arbitrage trading, exploiting price differences between exchanges, can yield smaller but more consistent profits of 1-3%. Longer-term strategies like staking, where you lock up your tokens to support the network and earn rewards, can generate 4-12% annually. Decentralised finance (DeFi) platforms offer even more complex strategies like yield farming, with the potential for annual percentage yields (APYs) exceeding 100%, but these carry even higher risks.

Several factors contribute to cryptocurrency's inclusion in this list. The 24/7 accessibility coupled with high volatility presents numerous profit opportunities, unavailable in most traditional markets. The low barrier to entry, thanks to fractional investing, allows individuals to start with small amounts. Finally, the multiple income strategies available – from day trading to staking and yield farming – cater to different risk appetites and investment horizons.

However, it's crucial to acknowledge the significant risks involved. The high volatility that creates opportunities can also lead to substantial losses. Success requires significant market knowledge, understanding of technical analysis, and constant vigilance. Regulatory uncertainty remains a concern in many jurisdictions, including the UK, and security risks associated with digital wallets are ever-present. Navigating the complex tax implications of cryptocurrency trading can also be challenging.

For those interested in exploring this avenue, here are some crucial tips: Start with small amounts and focus on major cryptocurrencies like Bitcoin and Ethereum. Use reputable exchanges with strong security measures and two-factor authentication. Implement strict risk management strategies, including stop-loss orders to limit potential losses. Keep detailed records of all transactions for tax purposes. Crucially, never invest more than you can afford to lose. Consider dollar-cost averaging, a strategy where you invest a fixed amount regularly, regardless of the price, to mitigate the impact of volatility.

Cryptocurrency and digital asset trading isn't a get-rich-quick scheme. It requires a combination of knowledge, skill, discipline, and risk tolerance. But for those willing to put in the effort and understand the risks involved, it can potentially offer a route to generating instant cash in the fast-moving world of digital finance.

While no specific websites are linked for financial advice, reputable exchanges like Coinbase and Binance, founded by Brian Armstrong and Changpeng Zhao respectively, are popular choices for UK traders. Remember to thoroughly research any platform before using it and to understand the associated risks. The underlying technology behind Bitcoin, pioneered by Satoshi Nakamoto, has revolutionized the financial landscape, and trading within this ecosystem offers exciting but volatile opportunities.

6. Asset-Based Lending and Collateralized Loans

When you need instant cash, and traditional lending avenues seem too slow or inaccessible, asset-based lending and collateralized loans can provide a viable solution. This method leverages the value of your possessions to secure a loan, offering a faster route to funds than unsecured personal loans. Essentially, you're using something you own as a guarantee for the money you borrow. This makes it an attractive option for those who might not qualify for traditional loans due to credit history, or for those who simply need money now. This method deserves its place on this list because of its speed and accessibility, particularly for individuals who may have valuable assets but lack a perfect credit score.

So, how does it work? You present an asset – this could be your car, jewellery, electronics, or even luxury items like watches or art – to a lender. The lender appraises the item to determine its current market value. Based on this valuation, they offer you a loan, typically a percentage of the asset's worth. The key difference between this and simply selling your item is that you retain ownership (and often, possession) of the asset while you repay the loan. Once the loan is fully repaid, including interest and any fees, your asset is returned to you.

For UK residents, there are several avenues for asset-based lending. Auto title loans, for example, allow you to borrow against the value of your vehicle, typically offering sums between £1,000 and £15,000. If you have valuable jewellery or electronics, pawn shops are a long-standing option, offering loans from £50 to £5,000 depending on the item. For those possessing high-value assets like art or collectibles, specialist luxury asset lenders cater to this niche market, often providing substantial loan amounts. Businesses can also leverage asset-based lending through equipment financing, using machinery or tools as collateral. Online platforms like Pawngo (though primarily US-based, they offer insights into the process) have modernised the pawnbroking experience, making it more accessible and convenient. Traditional pawn shops, found on many UK high streets, remain a readily available option for smaller loans.

Features and Benefits of Asset-Based Lending:

- Quick Appraisal and Valuation: Lenders typically provide a rapid assessment of your asset’s worth.

- Same-Day Funding Capabilities: In many cases, you can receive the cash on the same day your asset is approved. This makes it a truly "instant cash" option.

- No Extensive Credit Checks: Unlike traditional loans, your credit score plays a lesser role. The primary focus is the asset's value.

- Flexible Repayment Terms: Lenders often offer various repayment schedules to suit individual circumstances.

- Multiple Asset Types Accepted: From cars and electronics to luxury watches and artwork, a wide range of items can be used as collateral.

Pros and Cons:

Pros:

- Very fast approval and funding: Ideal for urgent financial needs.

- Credit score less important than asset value: Accessible to those with poor or limited credit history.

- Keep possession of asset during loan term (in most cases): You can continue to use your car, for example, while repaying the loan.

- Higher loan amounts than unsecured options: Leveraging the value of your assets can unlock larger loan amounts.

- Predictable interest rates and terms: You’ll know exactly what you’re paying and for how long.

Cons:

- Risk of losing collateral if unable to repay: This is the most significant downside. Defaulting on the loan means forfeiting your asset.

- Higher interest rates than traditional loans: Because these loans are considered higher risk for the lender, they typically come with higher interest rates.

- Asset must be appraised and verified: This process can take some time, although it’s generally faster than traditional loan applications.

- Limited to value of owned assets: You can only borrow up to a percentage of your asset’s appraised value.

- Additional fees for appraisal and processing: Be sure to factor these into the total cost of borrowing.

Tips for Using Asset-Based Lending:

- Shop around for the best rates and terms: Compare offers from different lenders before committing.

- Understand the total cost of borrowing, including all fees: Don't just focus on the interest rate. Factor in appraisal fees, processing fees, and any other charges.

- Have a realistic repayment plan before you borrow: Ensure you can comfortably afford the repayments to avoid the risk of losing your asset.

- Keep detailed records of your asset’s condition: This is especially important for items like cars or electronics. Documenting the condition beforehand can help prevent disputes later.

- Consider alternatives before using your primary vehicle as collateral: If your car is essential for work or daily life, carefully weigh the risks before using it to secure a loan. Explore other options if possible.

Asset-based lending provides a fast and relatively accessible route to instant cash, especially when traditional loans aren't an option. By understanding the process, weighing the pros and cons, and following these tips, you can make informed decisions and leverage the value of your assets responsibly. Remember to prioritize responsible borrowing and ensure you have a solid repayment plan to avoid the risk of losing your valuable possessions.

7. Service-Based Quick Income Opportunities

When you need instant cash, leveraging your skills and offering services within your local community can be a surprisingly effective solution. Service-based quick income opportunities represent a practical path to earning money fast without significant upfront investment. This approach allows you to turn existing skills, hobbies, or even just spare time into a revenue stream, making it a valuable addition to any list of instant cash strategies. Whether you're looking to supplement your regular income or need funds for an unexpected expense, providing services can offer the flexibility and control you need to get cash in hand quickly.

The core principle of service-based income is simple: identify a need within your community and offer a solution in exchange for payment. This can range from practical tasks like house cleaning and gardening to more specialized services like tutoring or pet care. The beauty of this approach is its minimal barrier to entry. You likely already possess skills that are in demand, eliminating the need for lengthy training or expensive certifications. Furthermore, the focus on local markets means you can connect directly with potential clients and build a customer base within your own neighbourhood.

Here are some examples of service-based income opportunities that can generate instant cash in the UK:

- House Cleaning: With the busy lives many lead, house cleaning is a consistently sought-after service. You can charge £15-30 per hour depending on the size of the property and the specific tasks involved.

- Pet Sitting/Dog Walking: Pet owners are often willing to pay for reliable care for their furry companions. Dog walking can earn you £10-20 per walk, while pet sitting rates range from £20-40 per day.

- Tutoring: If you excel in a particular subject, tutoring can be a rewarding and lucrative option. Hourly rates for tutoring can range from £20-50 depending on the subject and level of expertise.

- Handyman Services: Basic handyman tasks like assembling furniture, fixing leaky taps, or painting are always in demand. You can charge £25-60 per hour for these types of services.

- Gardening/Lawn Care: Maintaining gardens and lawns is another area where you can capitalize on local demand. Mowing lawns, trimming hedges, and weeding can earn you £30-80 per property.

Why Service-Based Income Deserves a Spot on the Instant Cash List:

- Immediate Income Potential: Unlike some online ventures that require building an audience or waiting for payouts, service-based work often allows you to receive payment immediately upon completion of the job, offering true instant cash potential.

- Flexibility and Control: You set your own rates, choose your working hours, and decide which services you want to offer. This level of control is particularly appealing to those looking for side hustles or flexible income streams.

- Low Startup Costs: Most service-based businesses require minimal investment. You likely already own the necessary equipment for many common services, significantly reducing startup costs and overhead.

- Building Relationships and Repeat Business: Providing excellent service can lead to long-term client relationships and repeat business, ensuring a more consistent income stream over time.

Actionable Tips for Success:

- Start with Your Strengths: Focus on services you're already proficient in to maximize efficiency and deliver high-quality work.

- Competitive Pricing: Research local market rates to ensure you're pricing your services competitively while still valuing your time and effort.

- Leverage Local Networks: Spread the word about your services through friends, family, and local community groups. Consider distributing flyers or posting in local shops.

- Utilize Online Platforms: Platforms like Nextdoor, Gumtree, and Facebook Marketplace are excellent resources for connecting with potential clients in your area.

- Professionalism is Key: Maintain a professional demeanour, communicate clearly, and be punctual. Positive reviews and referrals are crucial for building a strong reputation.

Pros and Cons:

Pros: Immediate income, control over schedule and pricing, low startup costs, potential for repeat business.

Cons: Physical labor may be required, income can be irregular initially, reliant on local market demand, requires self-marketing.

While service-based work may involve physical labor and require proactive marketing, the potential for instant cash, flexible scheduling, and direct connection with your community makes it a powerful tool for anyone looking to generate quick income. By focusing on your skills, providing excellent service, and leveraging local networks, you can successfully transform your abilities into a reliable source of instant cash in the UK.

8. Cashback and Rewards Optimization

Need instant cash without changing your spending habits? Cashback and rewards optimization is a clever strategy that leverages your everyday purchases to generate a steady stream of extra money. By strategically using cashback credit cards, reward apps, and loyalty programmes, you can effectively earn while you spend, transforming routine transactions into opportunities for financial gain. This method deserves its place on our list because it offers a sustainable and relatively effortless way to boost your funds, perfect for topping up your gaming budget, grabbing that new gadget, or simply having a little extra cash on hand.

This approach involves maximizing rewards across multiple platforms and converting points or cashback into spendable money quickly. Think of it as a silent partner contributing to your finances every time you shop for groceries, fill up your petrol tank, or buy that new game online. It's not a get-rich-quick scheme, but rather a smart and sustainable way to make your money work harder for you. For online gaming enthusiasts, prize seekers, tech and gadget fans, and anyone looking for a little extra cash, this method is a game-changer.

How it Works:

Cashback and rewards optimization involves signing up for various programmes designed to reward customer loyalty. These programmes come in several forms:

- Cashback Credit Cards: These cards offer a percentage of your spending back as cash, often with higher percentages in specific categories like supermarkets or petrol. Some cards even offer hefty sign-up bonuses, providing a lump sum of instant cash upon meeting spending requirements.

- Reward Apps: Apps like Ibotta and Fetch Rewards allow you to earn cashback on groceries and other household items by scanning receipts. Many also offer bonus cashback for purchasing specific products or shopping at particular retailers.

- Loyalty Programmes: Supermarkets (like Tesco Clubcard and Sainsbury's Nectar), retailers, and even petrol stations often have loyalty programmes that reward you with points for every purchase. These points can then be redeemed for discounts, vouchers, or sometimes even cash.

- Online Shopping Portals: Websites like Rakuten (formerly Ebates) offer cashback when you shop online through their portal. They partner with thousands of retailers, allowing you to earn a percentage back on purchases you were already planning to make.

Examples of Successful Implementation:

- Credit card sign-up bonus: Imagine securing a new credit card with a £200 bonus after spending £1,000 within the first three months. That's instant cash simply for using the card for your regular expenses.

- Grocery cashback: Using apps like Ibotta or CheckoutSmart and taking advantage of offers can easily net you £10-20 a month on your regular grocery shop. This adds up over time and can cover the cost of a new game or a subscription service.

- Online Shopping Cashback: Combine a cashback credit card with a portal like Rakuten and you can easily stack rewards. For example, a 1% cashback credit card coupled with a 5% Rakuten offer nets you 6% total cashback on that new gaming monitor.

- Bank Account Bonuses: Many UK banks offer switching bonuses of £100-£200 for opening a new current account and meeting certain criteria, providing another avenue for instant cash.

Actionable Tips for UK Residents:

- Focus on categories where you spend most: Prioritize cashback offers and rewards programs that align with your existing spending habits. If you frequently shop online, prioritize cashback websites and credit cards with bonus rewards for online purchases.

- Stack multiple rewards programmes: Combine cashback apps, credit card rewards, and loyalty schemes whenever possible to maximize your earnings.

- Pay credit card balances in full: Avoid interest charges that negate the benefits of cashback. Set up direct debits to ensure timely payments.

- Track spending and rewards: Monitor your spending and cashback earnings to ensure the rewards outweigh any annual fees or other associated costs. Use budgeting apps or spreadsheets to stay organised.

- Take advantage of limited-time offers: Be on the lookout for special promotions, bonus categories, and increased cashback rates.

When and Why to Use This Approach:

Cashback and rewards optimization is ideal for anyone looking to earn extra money without significant effort. It's particularly beneficial if you:

- Are a regular online shopper

- Frequently purchase groceries and household items

- Have good credit and can manage credit cards responsibly

- Are comfortable using apps and managing multiple accounts

Pros and Cons:

Pros:

- Earn money on everyday purchases.

- Multiple apps and cards can be stacked.

- Sign-up bonuses provide immediate cash.

- Minimal time investment required.

Cons:

- Requires discipline to avoid overspending.

- Cashback rates are typically 1-5%.

- Some platforms have minimum payout thresholds.

- Credit card rewards require good credit.

By implementing these strategies, you can effectively harness the power of cashback and rewards programmes to generate a steady stream of instant cash, helping you achieve your financial goals, whether it’s funding your gaming hobby, buying the latest tech, or simply enjoying some extra spending money.

Instant Cash Strategies Comparison

| Method / Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Gig Economy and Freelancing Platforms | Low to Medium (profile setup, reputation building) | Low (skills, internet access) | Flexible income, quick payouts, variable | Skilled individuals seeking flexible gigs | Fast income access, flexible schedule |

| Online Selling and E-commerce Flipping | Medium (product sourcing, listing management) | Medium (initial inventory, tools) | Scalable profits, turnover depends on market | Sellers with some capital and market knowledge | Scalable, flexible inventory management |

| Cash Advance Apps and Earned Wage Access | Very Low (app signup, account linking) | Very Low (steady job required) | Immediate small cash advances, short-term relief | Employees needing quick, small cash access | Fast access, no credit checks, low fees |

| Peer-to-Peer Lending and Borrowing | Medium (application, credit check) | Medium (income proof, credit needed) | Moderate loan amounts, faster than banks | Borrowers with moderate credit and needs $1k–$50k | Competitive rates, flexible terms |

| Cryptocurrency and Digital Asset Trading | High (market knowledge, strategy) | Low to Medium (capital, tech access) | Potential high returns, high volatility | Experienced traders comfortable with risk | 24/7 market, multiple profit strategies |

| Asset-Based Lending and Collateralized Loans | Low to Medium (asset appraisal, loan processing) | Medium (valued asset required) | Fast funding, high loan amounts | Asset owners needing quick cash | Fast approval, keeps asset possession |

| Service-Based Quick Income Opportunities | Low (local service setup, marketing) | Low (skills, minimal equipment) | Immediate hourly income, local repeat clients | Individuals with practical skills locally | Immediate income, low startup cost |

| Cashback and Rewards Optimization | Low (account setup, spending management) | Very Low (existing spend, credit) | Small but steady passive returns | People with regular spending and good credit | Earn money on normal purchases, instant rewards |

Choose the Right Path to Instant Cash

Finding the best route to instant cash requires careful consideration of your individual situation. This article explored various avenues, from the flexibility of the gig economy and the potential of online selling to the accessibility of cash advance apps and the strategic use of cashback rewards. We also touched upon more complex options like peer-to-peer lending, cryptocurrency trading, and asset-based loans. Each method offers unique advantages and disadvantages, and understanding these nuances is crucial for making sound financial decisions. Mastering these concepts empowers you to navigate short-term financial needs effectively and build a stronger foundation for your future. The key takeaway? Research thoroughly, weigh the pros and cons, and choose the path that best aligns with your individual financial goals. By optimizing your approach to instant cash, you can unlock opportunities, achieve financial flexibility, and gain greater control over your finances.

Want a fun and exciting way to try your luck at instant cash? Check out Lucky Turbo Competitions for a chance to win amazing prizes and potentially boost your bank account! Visit Lucky Turbo Competitions today and see what’s on offer.