Decoding the Modern Fraud Playbook

To get a real handle on avoiding online fraud, we have to look past the old advice. Criminals aren’t just sending out clumsy emails anymore; they’re running sophisticated operations that exploit our digital lives with scary accuracy. Their strategy is built on social engineering, a tactic where they manipulate people’s natural behaviours to get their hands on money or sensitive information. For example, a scammer might set up a fake competition website that’s a perfect clone of a real one, right down to the social media links, all to trick you into handing over your login details.

This growing complexity is clear from the latest figures. In 2024, losses from unauthorised transactions in the UK reached a staggering £722 million, and the number of reported fraud cases jumped by 14% to 3.13 million. These aren’t just abstract statistics; they represent real people whose lives have been affected by these advanced tactics. You can see a full breakdown of these numbers in the UK Finance annual fraud report. This sharp rise shows exactly why generic warnings just don’t cut it anymore.

The Psychology of Modern Scams

Today’s fraudsters are experts in psychological pressure. They create a sense of urgency or fear to make you bypass your logical thinking. Picture getting a message claiming your account for a favourite gaming site will be shut down unless you act immediately. This is a classic tactic designed to cause a panic, making you click before you’ve had a chance to think it through.

Scammers also tailor their attacks to specific groups. They know a message about a tax rebate from HMRC will have a much bigger impact closer to the end of the tax year. They are organised, patient, and have a deep understanding of what makes us tick. Recognising these psychological triggers is your first line of defence against their carefully planned schemes.

Reading Between the Lines: Advanced Warning Signs

Going beyond the obvious red flags that most people can spot, the real skill in avoiding online fraud is picking up on the subtle signals your gut is trying to tell you about. It’s about building a kind of fraud intuition, noticing the tiny details that give away an otherwise convincing scam. Let’s explore the micro-signals that can make all the difference.

Decoding Deceptive Language

Scammers often reveal themselves through their use of language, even when they’re trying to appear professional. Their main goal is to trigger an emotional reaction to get you to act without thinking. Be on the look out for these patterns:

- Overly formal or weirdly informal language: An email from your bank that reads like a complicated legal document, or a message from a company like “Lucky Turbo Competitions” using strange, casual slang, should make you stop and think. Real companies have a consistent voice and tone.

- Excessive compliments or urgent threats: Messages filled with flattery (“You’re our most valued customer!”) or alarming warnings (“Your account will be terminated!”) are classic manipulation tactics. They’re designed to make you feel special or scared, not to share genuine information.

Spotting Technical Inconsistencies

Even the most slick-looking fake websites often have technical slip-ups that expose them. Before you click or type anything, put on your digital detective hat. Check the domain name very carefully. A scam site might use luckyturbo-competitions.co instead of the genuine .co.uk address. Hover your mouse over any links without clicking; your browser will usually show the true destination URL in the bottom corner of the window. If the link text says one thing but the destination is a messy, unofficial-looking address, you’ve found a trap.

This careful approach is more important than ever. Worryingly, 50% of UK businesses reported experiencing cyber attacks or security breaches in 2024, a significant jump from 39% in 2022. These breaches lead to huge financial losses and show just how critical it is to stay vigilant. You can find out more about these UK cyber crime trends and statistics. With threats on the rise, developing these advanced detection skills is a must, not just a nice-to-have.

Creating Your Personal Security Ecosystem

Staying safe from online fraud isn’t about trying to remember a massive list of dos and don’ts. Instead, it’s about creating a layered security setup that works for you in the background, protecting you even when you’re busy or distracted. I like to think of it less as a fortress with rigid walls and more like a personal ecosystem, where different elements work together to keep you safe. The aim is to build good habits that don’t take much effort but offer a great deal of protection.

A big part of this ecosystem is managing your online footprint. One simple but powerful habit is using private browsing modes for everyday searches or when you’re on a public computer. For instance, Firefox’s private browsing feature automatically clears your session data—things like passwords and cookies—as soon as you close the window.

This is a perfect example of making privacy an easy, almost automatic choice. It cuts down your digital trail without you having to think about it.

Building Your Security Toolkit

Next, let’s get your core defences sorted. A solid security ecosystem is built on a few key tools that handle the heavy lifting for you. You don’t have to be a tech whizz; you just need to put the right foundations in place.

- Use a Password Manager: This one is a game-changer. A password manager, such as Bitwarden or LastPass, creates and remembers strong, unique passwords for every single website you use. All you need to recall is one master password. It single-handedly solves one of the biggest security headaches for most of us.

- Enable Two-Factor Authentication (2FA): Wherever you see the option—on your email, social media, and especially on gaming or competition sites—switch on two-factor authentication (2FA). It adds a crucial second check, usually a code sent to your phone, making it incredibly difficult for a fraudster to get into your account, even if they’ve somehow managed to steal your password. For a deeper dive into this and other vital measures, check out our guide on how to stay safe online. Taking this one simple step is one of the most effective things you can do to secure your online life.

Safeguarding Your Financial Life Online

Protecting your personal accounts is one thing, but keeping your money safe online requires its own level of vigilance. When real cash is on the line, the stakes are much higher. Knowing how to protect your banking and shopping activities is crucial for anyone wanting to steer clear of online fraud. It’s about shifting your mindset from just using strong passwords to actively questioning where and how you share your payment details. Before you even think about entering your card information on a competition site or a new online shop, get into the habit of doing a quick mental security check.

Smart Shopping and Banking Habits

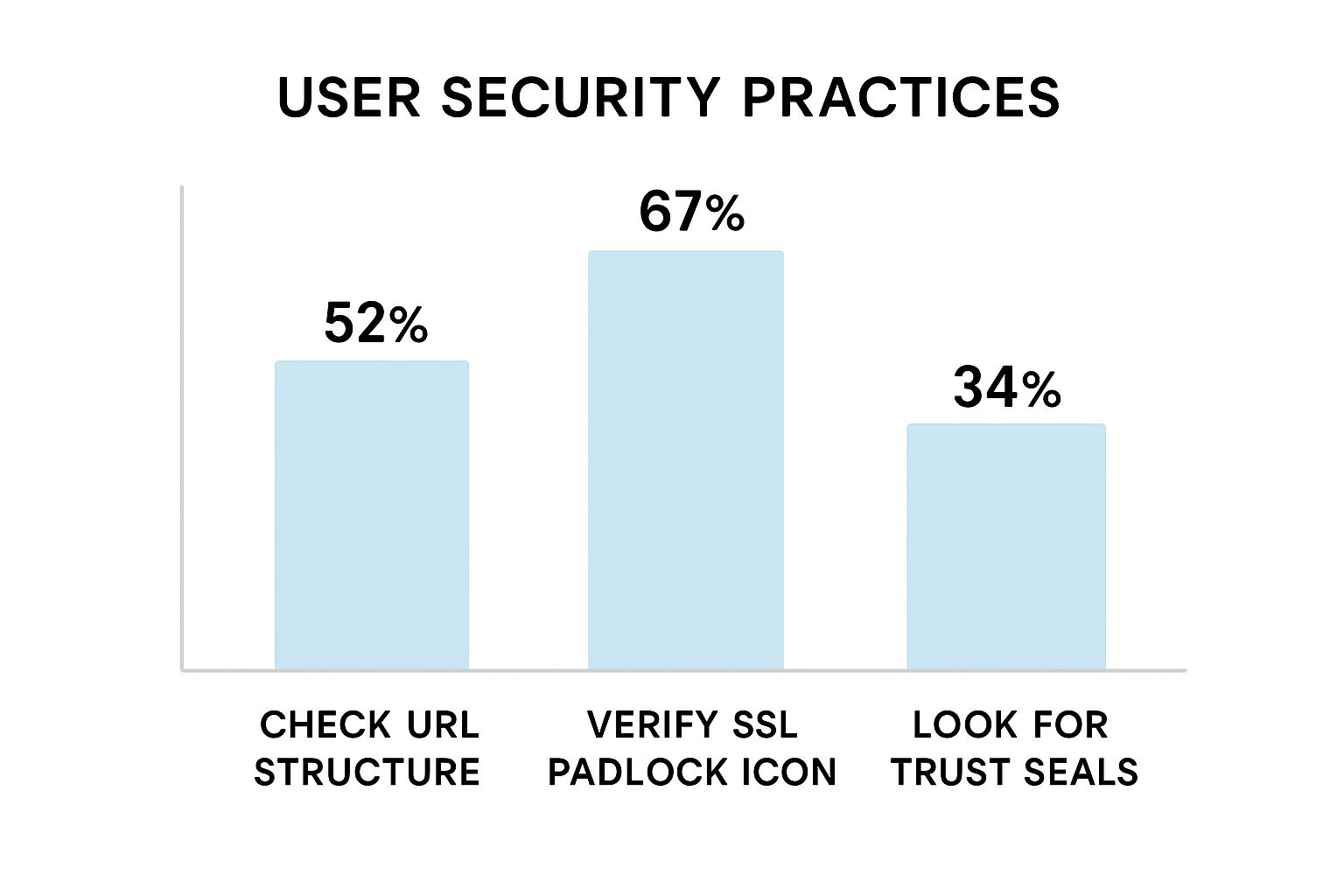

Developing a sharp eye for what’s legitimate is your best line of defence. Most people know the basic safety checks, but it’s surprising how many of us don’t apply them every single time. This simple chart shows just how often people perform these essential checks.

As you can see, while most of us look for the padlock symbol, far fewer take the time to inspect the URL or look for trust seals. This creates a gap that fraudsters are all too happy to exploit. And the problem is massive. The 2025 Cyber Security Breaches Survey revealed that UK businesses were hit by an estimated 8.58 million cyber crime incidents last year. You can read more about these startling figures in the UK Government’s cyber security findings.

Choosing the Right Payment Method

Not all payment methods offer the same level of security, and picking the right one can make a huge difference. To help you decide, here’s a quick comparison of the most common options and the protection they offer.

| Payment Method | Fraud Protection | Dispute Process | Risk Level | Best Use Cases |

|---|---|---|---|---|

| Credit Cards | Excellent. Section 75 protection for purchases over £100. | Relatively straightforward. Card provider is jointly liable. | Low | General online shopping, competition entries, buying from new retailers. |

| Debit Cards | Good. Chargeback scheme available but not as strong as Section 75. | Can be slower and more complex than with credit cards. | Medium | Everyday purchases from trusted, well-known retailers. |

| Payment Platforms (e.g., PayPal) | Strong. Buyer protection policies mask your card details from the seller. | Well-defined dispute resolution process within the platform. | Low | Peer-to-peer payments, shopping on sites like eBay, or when you prefer not to share card details directly. |

| Direct Bank Transfers | Very little to none. Extremely difficult to recover funds once sent. | Almost impossible to reverse a fraudulent transaction. | High | Paying trusted friends, family, or for verified services like a deposit on a flat. Never for online shopping or competitions. |

The key takeaway here is that some payment methods create a crucial buffer between a potential fraudster and your bank account. Credit cards and platforms like PayPal are generally your safest bets for online transactions, especially with sites you’re using for the first time.

Think about the difference in risk:

- Credit Cards: These offer the strongest protection. Thanks to Section 75 of the Consumer Credit Act, your card provider is jointly liable with the retailer for purchases between £100 and £30,000. This gives you a powerful safety net if goods don’t arrive or a service isn’t provided.

- Debit Cards: While convenient, the money comes straight out of your account. Getting it back through the chargeback scheme is possible, but it’s a voluntary arrangement by the banks and can be a slower, more complicated process.

- Direct Bank Transfers: These are the riskiest choice for buying goods or entering competitions online. Once the money is sent, retrieving it is often impossible if the transaction turns out to be a scam. You should avoid using bank transfers for any kind of online purchase from a vendor.

Making a conscious choice to use a credit card or a trusted payment platform for your online activities is a simple habit. It can be the difference between a minor annoyance and a major financial headache.

Building Fraud-Resistant Daily Habits

Properly protecting yourself from fraud isn’t about memorising a massive list of dos and don’ts. It’s about weaving small, effective habits into your daily online life until they become second nature. The aim is to make secure choices automatically, especially when you’re in a rush or distracted.

Think of it like developing security muscle memory. For instance, getting into the habit of pausing for just five seconds before clicking any link in an unexpected email or message can be a game-changer. Just ask yourself: “Was I expecting this?” This tiny, ingrained hesitation is a powerful defence against scams that rely on creating a false sense of urgency.

Another powerful habit is to regularly review your account activity. This doesn’t need to be an exhaustive daily task. You could set a recurring reminder on your phone—maybe for a Sunday evening—to quickly scan your bank, email, and key gaming or competition accounts for anything that looks out of place. This simple routine check makes it much more likely you’ll catch suspicious activity before it becomes a major problem.

Reinforce Your Digital Environment

A brilliant way to support these new habits is to organise your digital life to make safe choices the easy choices. One of the most significant changes you can make is to beef up your account recovery options.

For example, take a look at Google’s account recovery setup screen:

This screenshot shows how you can add a recovery phone number and a backup email address. By taking just 10 minutes to set these up properly, you create a solid safety net. This makes it substantially harder for a fraudster to lock you out of your own account if they do manage to get your password. It’s a simple, one-off action that offers security benefits for years to come.

Your Action Plan When Fraud Strikes

Even with the best security habits, fraud can sometimes slip through the cracks. The moment you spot something that isn’t right—maybe a strange transaction on your bank statement or a login alert for a gaming account you didn’t authorise—how you react in those first few hours is crucial. A quick, calm response can stop a small problem from turning into a major financial headache.

Who to Contact First

Your first job is to stop any more damage. It’s easy to feel a surge of panic, but working through a checklist methodically will put you back in control.

- Call Your Bank or Card Provider: This is your absolute first port of call. If your financial details have been compromised, they can instantly freeze your cards and block any dodgy transactions. The number is usually on the back of your card. Just explain clearly what you’ve found.

- Change Your Passwords: As soon as you’re off the phone with the bank, change the password for the affected account. If you’ve made the common mistake of reusing that password elsewhere, you’ll need to change those too. Start with your main email account, as this is often the master key to all your other online profiles.

- Report the Fraud: Once your accounts are secure, the next step is to officially report the crime. This is essential for helping the police track down criminals and is often a requirement for getting your money back. In the UK, the official body for this is Action Fraud.

Here is what the official reporting page for Action Fraud, the UK’s national fraud and cybercrime reporting centre, looks like:

You can use their service to report fraud and cybercrime 24/7, which is a vital first step in the recovery process. Reporting doesn’t just help your own case; it contributes to a wider, national picture of fraud, which helps protect others from becoming victims. As you go through this, it’s also wise to understand your position; you can learn more about your consumer rights in our detailed guide.

Staying Ahead of Evolving Threats

The world of online fraud is always shifting, which means our methods for staying safe need to adapt as well. This doesn’t mean you have to become a cybersecurity expert or live in constant fear. The trick is to build smart habits that keep you protected without feeling like a full-time job. Staying ahead of threats is more about periodic check-ins than constant worry.

For instance, a few times a year, maybe once a quarter, take 15 minutes to search for the latest scams targeting online gaming or competition fans in the UK. A quick search on a trusted news site or cybersecurity blog is all it takes. This simple habit keeps you aware of new tricks scammers are trying, so you know what to look out for.

Keeping Your Security Current

It’s crucial to know when to give your security a refresh. A good rule of thumb is to review your core security settings at least twice a year. This includes changing passwords on important accounts (like your primary email and banking) and making sure two-factor authentication is still switched on everywhere it matters. If you see a major data breach in the news involving a service you use, that’s your signal to immediately change your password for that site and any others where you used the same one.

Sharing what you learn is another powerful move. You can help protect your mates and family without becoming their go-to IT support person. Instead of just fixing a problem for them, why not share a helpful resource like this guide? You could even start an informal group chat where you and your friends can quickly warn each other about suspicious emails or dodgy-looking messages you receive. It builds a strong circle of mutual protection.

And for those who enjoy trying their luck online, it’s just as important to spot legitimate opportunities. You can learn more about secure instant win competitions to see how trustworthy platforms operate and what signs to look for. By taking these small, manageable steps, you can create a solid and flexible defence against new threats, giving you peace of mind while you’re online.