Turning Your Lucky Streak into Lasting Wealth

Winning the lottery can be life-changing, but managing a windfall wisely is crucial for long-term financial security. This listicle provides essential lottery winners financial advice, covering eight key strategies to help you make the most of your winnings. Learn how to invest strategically, create multiple income streams, protect your assets with trusts and estate planning, and implement effective wealth management techniques like the 50/30/20 rule and systematic withdrawals. We’ll also explore anonymous claiming, philanthropic giving, and the importance of assembling a professional team. This guide empowers UK lottery winners to transform a lucky moment into lasting prosperity.

1. Take the Lump Sum and Invest Strategically

Winning the lottery is a dream come true, but managing the windfall wisely is crucial for long-term financial security. One of the most important financial decisions a lottery winner faces is choosing between receiving the winnings as a lump sum or an annuity. For those seeking to maximise their potential wealth and maintain control over their finances, taking the lump sum and investing it strategically is often the recommended path. This strategy involves taking the full lottery winnings as a one-time payment (minus taxes) and then investing the proceeds in a diversified portfolio designed to generate returns that outpace the annuity payments over time. This approach requires careful planning, discipline, and a solid understanding of investment principles, but it offers the potential for significantly higher returns and greater financial flexibility. This approach is a cornerstone of sound lottery winners financial advice.

Opting for the lump sum provides immediate access to the full winnings (after taxes), empowering winners to take control of their financial destiny. Rather than receiving fixed payments over several decades, you gain the flexibility to invest the capital according to your individual goals and risk tolerance. This control extends to estate planning, allowing you to leave a substantial inheritance to your heirs. Moreover, you have the flexibility to adjust your investment strategy as market conditions change and your financial objectives evolve.

Several lottery winners have demonstrated the potential of this approach. Brad Duke, a Powerball winner, opted for the $85 million lump sum and through strategic investing, built a diversified portfolio worth over $128 million. While not every winner achieves such spectacular results, these examples highlight the power of disciplined, long-term investing. Many savvy winners choose to work with established firms like Vanguard or Fidelity, known for their low-cost index fund offerings and robust investment platforms.

However, the lump-sum strategy is not without its risks. It requires investment knowledge and the discipline to stick to a long-term plan. Market fluctuations can impact portfolio values, and the temptation to overspend initially can be significant. Furthermore, the immediate tax burden is higher with a lump sum compared to annuity payments, which are taxed incrementally over time. Unlike an annuity, the lump-sum approach does not provide a guaranteed income stream, placing greater responsibility on the winner to manage their finances effectively.

Here are some actionable tips for those considering the lump-sum investment strategy:

- Seek Professional Guidance: Before making any decisions, consult with a fee-only financial advisor. They can help you develop a personalized investment plan tailored to your specific goals and risk tolerance. This is crucial for navigating the complexities of managing a large sum of money.

- Diversify Your Investments: A diversified portfolio is essential for mitigating risk. Consider a balanced approach like a 60/40 stock/bond allocation, which provides a blend of growth potential and stability.

- Dollar-Cost Averaging: Instead of investing the entire lump sum at once, consider dollar-cost averaging. This involves investing a fixed amount at regular intervals, reducing the impact of market volatility.

- Build a Cash Reserve: Set aside 6-12 months of living expenses in a readily accessible cash account. This provides a financial safety net and prevents the need to sell investments during market downturns.

- Focus on Low-Cost Funds: Avoid individual stock picking and stick to diversified, low-cost index funds or exchange-traded funds (ETFs). This strategy is widely recommended by financial experts like Warren Buffett and John Bogle, the founder of Vanguard.

The lump-sum strategy deserves its place on this list because it offers the highest potential for long-term wealth creation and provides the winner with complete control over their finances. By following these tips and working with qualified financial advisors, UK lottery winners can navigate the complexities of managing a sudden windfall and build a secure financial future. While the immediate tax burden and market risks are real, the potential for higher returns, coupled with the flexibility and control afforded by the lump-sum option, makes it a compelling choice for those seeking to maximise their lottery winnings.

2. Create Multiple Income Streams Through Real Estate

Winning the lottery can be a life-changing event, offering financial freedom many only dream of. However, without a sound financial strategy, even the largest windfall can disappear quickly. That’s where smart investing, like building multiple income streams through real estate, becomes crucial. This strategy involves using your winnings to create a diversified real estate portfolio that generates passive income, providing long-term financial security and making your money work for you. This approach is particularly relevant to lottery winners offering a stable foundation for managing their newfound wealth. It allows winners to move beyond the initial euphoria and establish a sustainable financial future. By diversifying into real estate, winners can protect their capital, generate consistent income, and build wealth for generations to come.

This approach works by leveraging the power of tangible asset ownership. Instead of relying solely on stocks or bonds, you invest in physical properties that generate regular rental income. This income stream, combined with the potential for property appreciation, creates a robust financial safety net. Furthermore, the UK offers several tax advantages related to property ownership, including deductions for mortgage interest, maintenance, and other expenses. This allows you to maximise your returns and build wealth more effectively. Think of it as creating a financial engine powered by bricks and mortar, steadily generating income regardless of market fluctuations.

Consider these practical examples: A lottery winner could purchase a block of flats in a growing UK city like Manchester or Birmingham, providing a steady stream of rental income. Alternatively, they might invest in commercial property in London, benefiting from high demand and potential for significant appreciation. For those seeking more diversified exposure, investing in Real Estate Investment Trusts (REITs) can provide access to a portfolio of properties across different sectors without the direct management responsibilities. Finally, purchasing a holiday let in popular tourist destinations like Cornwall or the Lake District can generate substantial income during peak seasons.

Here are some actionable tips for UK lottery winners looking to build wealth through real estate:

- Start Local: Begin your investments in familiar markets. Understanding local regulations, rental demand, and property values can reduce risk and simplify management. Focus on areas experiencing population growth and economic development within the UK.

- Professional Management: Consider hiring a reputable property management company. This will handle tenant screening, rent collection, maintenance, and legal compliance, freeing up your time and minimizing headaches. This is especially valuable if you are new to property management.

- Diversification is Key: Don’t put all your eggs in one basket. Invest across different property types (residential, commercial, holiday lets) and locations to mitigate risk and maximize potential returns. Diversification is a cornerstone of sound financial planning, even more so for lottery winners.

- Maintain Liquidity: While property is a valuable asset, it is also illiquid. Allocate 20-30% of your real estate portfolio to REITs, which are traded on stock exchanges and offer greater liquidity. This allows you to access funds quickly if needed without having to sell physical properties.

- Factor in All Costs: Don’t just focus on the purchase price. Consider all associated costs, including stamp duty, legal fees, maintenance, repairs, property taxes, insurance, and potential vacancy periods. Accurately estimating these expenses is crucial for realistic financial projections.

The benefits of creating multiple income streams through real estate are numerous. You gain steady monthly cash flow from rental income, benefit from the historical tendency of property values to appreciate over time, and access various tax benefits and deductions. Professional management options allow you to enjoy passive income without the daily grind of managing properties directly. Furthermore, real estate provides valuable diversification from the volatility of stocks and bonds, creating a more balanced and resilient portfolio.

However, there are also drawbacks to consider. Real estate requires active management or the expense of hiring property managers. It is an illiquid investment, meaning you can’t quickly convert it to cash. Market cycles can affect property values, and maintenance and repair costs can be unpredictable. Finally, tenant and vacancy risks can impact your income stream.

This approach has been popularized by prominent figures like Robert Kiyosaki, author of “Rich Dad Poor Dad,” who advocates for real estate as a key component of wealth building. Barbara Corcoran, a real estate mogul and investor, also frequently emphasizes the power of real estate investing. Furthermore, online communities like BiggerPockets provide valuable education and resources for aspiring real estate investors. By following their advice and implementing the tips provided, lottery winners in the UK can transform their windfall into a secure and prosperous future.

3. Establish a Trust and Estate Planning Structure

Winning the lottery is a life-changing event, bringing with it a sudden influx of wealth. While exciting, managing such a large sum responsibly requires careful planning. This is where establishing a trust and estate planning structure becomes crucial, forming a cornerstone of sound financial advice for lottery winners. This proactive step ensures your newfound wealth is protected, efficiently managed, and distributed according to your wishes, both now and for generations to come. It offers a framework for managing your winnings in a way that minimizes tax burdens, protects your privacy, and provides for your loved ones.

A trust is a legal entity that holds and manages assets on behalf of beneficiaries. By placing your lottery winnings into a trust, you separate your personal assets from the windfall, providing a layer of protection from creditors and potential lawsuits. Estate planning, in conjunction with a trust, dictates how your assets will be distributed after your lifetime, ensuring your wishes are respected and your legacy secured. This combined approach offers a powerful toolkit for safeguarding your financial future.

For UK lottery winners, several types of trusts offer unique advantages. An irrevocable life insurance trust (ILIT) can be particularly useful for minimizing inheritance tax, a significant concern for large estates. A charitable remainder trust (CRT) allows you to support your chosen charities while also receiving tax benefits. A generation-skipping trust is designed to pass wealth directly to grandchildren or later generations, mitigating inheritance tax across multiple generations. Furthermore, utilizing a blind trust, where an independent trustee manages the assets without your direct involvement, can help maintain anonymity, a significant concern for many lottery winners in the UK who wish to avoid unwanted attention.

Implementing a robust trust and estate plan involves several key considerations. Work with experienced estate planning attorneys specializing in UK law. They can guide you through the complexities of trust creation and ensure compliance with relevant regulations. Consider incorporating charitable giving strategies into your plan to potentially reduce your tax burden while supporting causes you care about. Structure distributions to beneficiaries thoughtfully, perhaps staggering payments or tying them to specific milestones to encourage responsible financial behaviour. Regularly review and update your trust documents to reflect changing circumstances and ensure they remain aligned with your goals. Finally, understand UK laws regarding lottery winner anonymity and how your trust structure can help you maintain your privacy if desired.

Pros of Establishing a Trust and Estate Planning Structure:

- Significant tax savings over time: Trusts offer various tax advantages, particularly concerning inheritance tax and capital gains tax.

- Protection from frivolous lawsuits: Assets held in trust are generally protected from creditors and legal claims against you personally.

- Maintains family privacy: Trusts can help shield your financial affairs from public scrutiny.

- Prevents beneficiaries from squandering inheritance: Structured distributions and trustee oversight can promote responsible financial management among beneficiaries.

- Professional management available: Trustees provide expert management of trust assets, relieving you of the burden and ensuring sound investment strategies.

Cons of Establishing a Trust and Estate Planning Structure:

- Complex legal and tax structures: Setting up and managing a trust can be intricate, requiring specialized legal and financial expertise.

- Ongoing administrative costs: Trustee fees and other administrative expenses can be significant.

- Less direct control over assets: Placing assets in trust means relinquishing some degree of control over their management.

- Potential family conflicts over trust terms: Disagreements among beneficiaries regarding trust provisions can arise.

- Requires experienced legal counsel: Navigating the legal complexities of trusts necessitates the involvement of qualified professionals.

While establishing a trust and estate plan requires effort and investment, it’s a critical step for lottery winners who want to protect their wealth, provide for their families, and manage their finances wisely. This approach provides a structured, legally sound framework for navigating the complexities of sudden wealth and securing a prosperous future for yourself and generations to come. This is why it deserves a prominent place in any lottery winner’s financial advice.

4. The 50/30/20 Scaled Wealth Allocation Rule

Winning the lottery can be a life-changing event, but managing the windfall wisely is crucial for long-term financial security. Amidst the excitement, implementing a structured approach to your newfound wealth can prevent overspending and ensure a secure future. That’s where the 50/30/20 Scaled Wealth Allocation Rule comes in. This method, adapted from a popular budgeting technique, provides lottery winners with a clear framework for managing their winnings, balancing immediate needs and long-term goals while incorporating a philanthropic component.

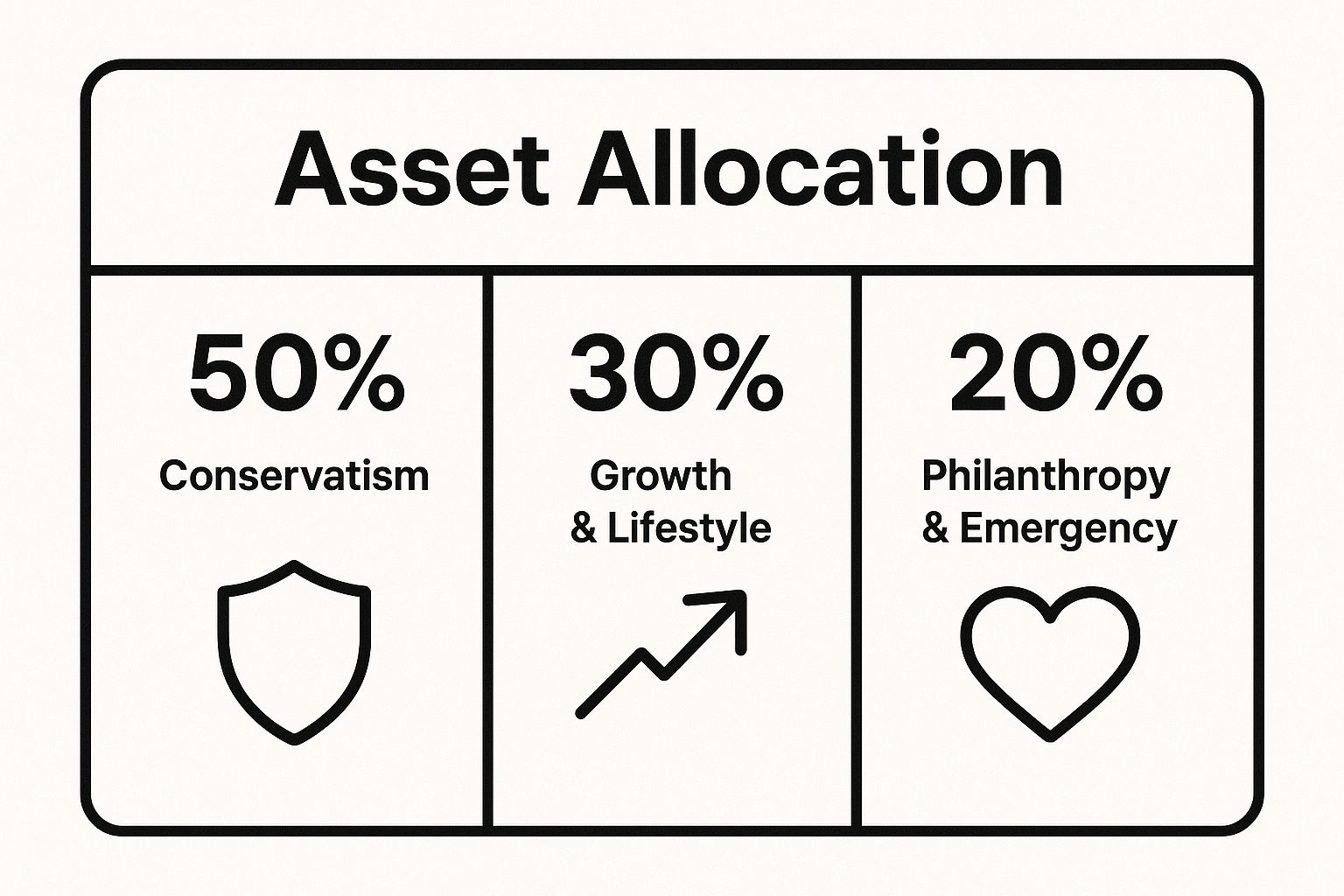

This rule divides your winnings into three main categories:

- 50% for Conservative Investments and Necessities: This portion focuses on securing your financial foundation. It covers essential expenses like housing, bills, debt repayment, and crucial conservative investments. Think of this as your safety net, ensuring you have a stable base to build upon. Examples of suitable conservative investments include UK government bonds, Premium Bonds, high-yield savings accounts, and Certificates of Deposit (CDs).

- 30% for Growth Investments and Lifestyle: This portion allows for a measured approach to improving your lifestyle and pursuing growth opportunities. It covers discretionary spending like travel, hobbies, upgrading your car, and investments aimed at increasing your wealth. This could include a diversified portfolio of stocks, index funds, investment trusts, and even venturing into property investment within the UK market. This balance allows you to enjoy your winnings responsibly while aiming for further financial growth.

- 20% for Philanthropy and Emergency Funds: This portion addresses two critical aspects: building a financial safety net and giving back to the community. A sizeable emergency fund, covering 2-3 years of essential expenses, acts as a buffer against unexpected events. The philanthropic component allows you to support causes you care about, leaving a positive impact with your winnings. Consider setting up a charitable trust or exploring various giving options within the UK.

The 50/30/20 rule deserves a spot on this list because it provides a simple, scalable, and balanced approach to managing lottery winnings, regardless of the amount. Its inherent flexibility within each category allows for personalization based on individual circumstances, age, and risk tolerance.

Here’s a quick reference infographic summarizing the key elements of the 50/30/20 Scaled Wealth Allocation Rule:

This infographic neatly visualizes the core principle of balancing security, growth, and giving back to the community.

For example, if you win £10 million, this rule would allocate £5 million to conservative investments and necessities, £3 million to growth investments and lifestyle enhancements, and £2 million to philanthropy and your emergency fund. The conservative portion could be invested in secure instruments like government bonds and high-yield savings accounts. The growth portion could be allocated to a diversified portfolio of stocks and perhaps some property investments in the UK. Your emergency fund should comfortably cover a few years of living expenses, providing a cushion for unforeseen circumstances.

Actionable Tips for Implementing the 50/30/20 Rule:

- Adjust Percentages: While the 50/30/20 split offers a solid starting point, feel free to adjust the percentages based on your age, risk tolerance, and financial goals. A younger winner might allocate a larger portion to growth investments, while someone closer to retirement might prioritize the conservative segment.

- Automate Transfers: Set up automatic transfers to designated accounts for each category to maintain discipline and prevent overspending.

- Review Allocations Annually: Your financial situation and goals can evolve. Review and rebalance your allocations at least once a year to ensure they still align with your needs.

- Consider Tax Implications: Be mindful of UK tax laws and regulations when making investment decisions and rebalancing your portfolio. Consult with a qualified financial advisor to optimise your strategy for tax efficiency.

- Start Conservative: If you’re new to investing, it’s wise to start with a more conservative approach and gradually increase your risk tolerance as you gain experience and confidence.

While the 50/30/20 rule provides valuable guidance, it’s essential to be aware of its limitations. It may not be suitable for everyone, and the fixed percentages might not always be the most tax-efficient approach. For complex estate planning or specialized financial situations, consulting with a qualified financial advisor in the UK is crucial. They can provide personalized advice tailored to your specific circumstances, maximizing your winnings and securing your financial future.

5. Anonymous Claiming and Stealth Wealth Management

Winning the lottery is a dream come true, but the sudden influx of wealth can bring unwanted attention, jeopardizing your safety, privacy, and peace of mind. This is where anonymous claiming and stealth wealth management become crucial aspects of lottery winners financial advice. These strategies are designed to protect your newfound fortune and allow you to enjoy your winnings without the pressures of public scrutiny and constant solicitations.

Anonymous claiming involves legally shielding your identity from the public when you collect your winnings. This isn’t possible in every jurisdiction, and the UK unfortunately doesn’t offer a direct route to anonymous claiming. Camelot, the UK National Lottery operator, is obligated to publicize winners’ names and locations. However, you can still take steps to maintain a degree of privacy and control the flow of information. Setting up legal structures before claiming your prize is essential for the best possible outcome. Consulting with a solicitor specializing in trusts and wealth management is highly recommended. They can advise on establishing a blind trust or other legal entities that can claim the prize on your behalf, offering a layer of separation between your public persona and your newfound wealth.

Stealth wealth management complements anonymous claiming by focusing on discreetly managing your finances to avoid attracting unwanted attention. This involves a range of strategies, from using separate PO boxes and dedicated phone numbers for lottery-related communications, to working with financial advisors who specialize in high-net-worth individuals and understand the importance of discretion. A crucial aspect of this is assembling a professional team. This team should include a solicitor, a financial advisor, and potentially a security consultant. Their combined expertise can help you navigate the complexities of managing substantial wealth while safeguarding your privacy.

Features of Anonymous Claiming and Stealth Wealth Management:

- Legal Structures: Trusts, LLCs (in permissible jurisdictions), and other legal entities can help shield your identity.

- Discrete Wealth Management Practices: Careful selection of financial advisors and institutions with experience in handling large sums discreetly.

- Security and Privacy Protocols: Implementing measures to protect personal information and physical security.

- Gradual Lifestyle Adjustments: Avoiding ostentatious displays of wealth and making changes incrementally.

- Professional Wealth Management Teams: Assembling a team of experts to manage legal, financial, and security matters.

Pros:

- Protects Personal Safety and Security: Reduces the risk of becoming a target for criminals.

- Reduces Constant Requests for Money: Minimizes solicitations from family, friends, and strangers.

- Maintains Normal Relationships: Allows you to maintain existing relationships without the dynamic being altered by wealth.

- Prevents Targeting by Scammers: Reduces the likelihood of falling prey to scams targeting lottery winners.

- Allows for Gradual Lifestyle Adjustment: Enables a smoother transition to a new financial reality.

Cons:

- Limited Options in Many States (and the UK): Anonymous claiming is not universally available.

- Additional Legal and Administrative Costs: Setting up and maintaining legal structures incurs expenses.

- May Complicate Some Financial Transactions: Increased due diligence may be required for certain transactions.

- Requires Ongoing Vigilance: Maintaining privacy requires constant effort and attention.

- Can Create Social Isolation: Choosing to keep your win a secret can strain relationships if not handled carefully.

Examples:

While the UK doesn’t offer the same anonymity as Delaware (where LLCs can claim prizes), using a trust to receive the winnings can offer some level of privacy. Engaging security services, especially for larger jackpots, is a common practice amongst high-profile winners globally. Gradual home improvements and investments, rather than extravagant purchases, are hallmarks of stealth wealth management.

Tips for UK Lottery Winners:

- Seek Legal Counsel Immediately: Before claiming, consult a solicitor specializing in trusts and wealth management.

- Establish a Trust: Explore setting up a blind trust to claim the prize and manage assets discreetly.

- Maintain Privacy in Communications: Use dedicated PO boxes, email addresses, and phone numbers for lottery-related matters.

- Educate Family Members on Privacy: Emphasize the importance of discretion to your close circle.

- Consider Professional Security Consultation: Evaluate your security needs and explore options for personal protection.

Although complete anonymity may be challenging in the UK, incorporating elements of stealth wealth management can significantly enhance your privacy and security after a lottery win. This thoughtful approach allows you to enjoy the benefits of your winnings while mitigating the risks associated with sudden wealth, making it a vital component of lottery winners financial advice.

6. Systematic Withdrawal Rate Strategy

Suddenly finding yourself with a life-changing lottery win can be exhilarating, but managing that newfound wealth wisely is crucial for long-term financial security. Amidst the excitement, adopting a structured approach to your finances is paramount. That’s where the Systematic Withdrawal Rate Strategy, a cornerstone of sound lottery winners financial advice, comes into play. This strategy offers a disciplined framework for preserving your winnings and generating a reliable income stream for years, even generations, to come.

This method, rooted in retirement planning principles, operates on the premise of investing your lump sum and withdrawing a predetermined percentage annually. This percentage, typically between 3-4%, is carefully calculated to allow your principal to grow and keep pace with inflation, ensuring your wealth remains sustainable over the long haul. It’s a powerful tool for transforming a windfall into a lifetime of financial security.

The Systematic Withdrawal Rate Strategy hinges on several key features: establishing a sustainable withdrawal rate, prioritizing principal preservation, adjusting withdrawals for inflation, diligently rebalancing your investment portfolio, and focusing on long-term wealth sustainability. These combined elements work together to protect and grow your winnings.

Let’s illustrate with an example relevant to UK lottery winners. Imagine winning a £20 million jackpot. Applying the 4% rule, your annual income would be £800,000. This substantial sum allows for a comfortable lifestyle while ensuring your principal remains intact. The renowned Trinity Study, which analyzed historical market data, supports the effectiveness of the 4% rule, demonstrating its success in maintaining portfolio longevity across various market conditions. This strategy is also a core tenet of the FIRE (Financial Independence, Retire Early) movement, demonstrating its versatility in achieving long-term financial goals. Even Nobel Prize winner William Sharpe’s research lends credence to the importance of carefully calculated withdrawal rates.

The Systematic Withdrawal Rate Strategy offers a range of compelling advantages. Its mathematically proven sustainability offers peace of mind, protecting you from the common pitfall of prematurely depleting your winnings. The strategy provides a predictable annual income, allowing for effective budgeting and financial planning. Moreover, it preserves wealth for future generations, creating a lasting legacy. Crucially, the strategy incorporates mechanisms to adjust for inflation, ensuring your purchasing power remains strong over time.

However, like any financial strategy, there are potential drawbacks to consider. The structured nature of the approach may feel restrictive compared to having access to your total wealth. It requires discipline to adhere to the withdrawal limits, especially during times of unexpected expenses or tempting investment opportunities. Market downturns can temporarily impact the available funds, potentially necessitating adjustments to spending. Additionally, the strategy may not readily accommodate major life changes that significantly alter your financial needs. Finally, its conservative nature might limit certain lifestyle options that require significant upfront capital.

To successfully implement this strategy, consider these actionable tips. Starting with a slightly lower withdrawal rate, such as 3.5%, provides an added safety margin, especially in the initial years. Ensure your withdrawal calculations account for UK tax implications. Be mindful of the “sequence of returns risk,” where negative market returns in the early years can disproportionately impact your portfolio’s longevity. As your portfolio matures, consider employing strategies like the “bond tent” to further mitigate risk. Finally, review and adjust your strategy annually based on your portfolio’s performance and changing financial circumstances.

The Systematic Withdrawal Rate Strategy is a powerful tool for lottery winners seeking long-term financial security. Popularized by figures like William Bengen, the creator of the 4% rule, and championed by the FIRE movement, this strategy has become a cornerstone of sustainable wealth management. By adopting this approach, UK lottery winners can transform their windfall into a lifetime of financial freedom and leave a lasting legacy for generations to come. This method deserves its place on this list because it offers a structured, proven approach to managing significant wealth, turning a one-time event into long-term prosperity. It addresses the unique challenges faced by lottery winners, helping them navigate the complexities of sudden wealth and secure their financial future.

7. Philanthropic Impact and Tax Optimization Strategy

Winning the lottery can dramatically change your life, but it also presents a unique opportunity to make a significant positive impact on the world. As part of sound lottery winners financial advice, incorporating a philanthropic strategy isn’t just about giving back; it’s also about smart financial planning. This approach allows you to create a lasting legacy while optimising your tax burden – a crucial aspect of managing your newfound wealth. This strategy deserves a place on this list because it addresses both the financial and personal implications of a large windfall, allowing winners to make the most of their good fortune while contributing to causes they care about.

This strategy involves using your winnings to support charitable causes while leveraging various giving vehicles to minimise your tax liability. It’s about making your money work harder for both you and the beneficiaries of your generosity. This isn’t simply writing a cheque; it’s about creating a structured, long-term plan for giving. This is particularly relevant in the UK, where tax laws provide incentives for charitable giving, making it a key component of effective lottery winners financial advice.

Several charitable giving vehicles can facilitate this approach, each with its own set of benefits and considerations:

- Donor-Advised Funds (DAFs): DAFs offer flexibility and simplicity. You contribute to the fund and receive an immediate tax deduction. You can then recommend grants to charities over time. Fidelity Charitable and Schwab Charitable (though US-based, they can accept UK donations under certain circumstances) are prominent examples, and similar structures are available in the UK. DAFs are an excellent starting point for those new to strategic philanthropy.

- Private Foundations: Establishing a private foundation provides more control over grant-making and can involve your family in the process, fostering multi-generational giving. You manage the foundation’s investments and decide which charities to support. This option requires more administrative overhead and ongoing compliance.

- Charitable Remainder Trusts (CRTs): CRTs offer a way to support charities while also receiving an income stream for yourself or your beneficiaries. You transfer assets to the trust, and the charity receives the remainder after a specified period. This can be particularly appealing for winners seeking to balance charitable giving with long-term financial security.

- Direct Funding: You can also directly donate to registered charities, which is the most straightforward approach but might offer fewer tax advantages compared to the other options. This method is ideal for supporting specific projects or organisations you are passionate about.

Pros of a Philanthropic Tax Optimization Strategy:

- Substantial Tax Savings: Charitable donations can significantly reduce your Income Tax and Inheritance Tax liabilities, freeing up more resources for both your personal use and continued giving.

- Meaningful Social Impact: You can direct your funds towards causes you care about, making a tangible difference in areas like education, healthcare, or environmental conservation.

- Family Purpose and Legacy: Philanthropy can provide a shared purpose for your family, creating a lasting legacy that extends beyond your lifetime.

- Reduces Taxable Estate: Strategic giving can minimise inheritance tax, ensuring more of your wealth benefits your chosen beneficiaries and charities.

- Potential Income Streams (CRTs): CRTs can offer a reliable income stream while supporting your chosen causes.

Cons of a Philanthropic Tax Optimization Strategy:

- Irrevocable Charitable Commitments: With some vehicles, like foundations and CRTs, commitments are irrevocable. This requires careful planning to ensure you are comfortable with the long-term implications.

- Complex Administrative Requirements: Managing a private foundation or CRT involves ongoing administrative work and compliance with regulations.

- Ongoing Compliance Obligations: Foundations and trusts are subject to ongoing regulatory requirements and reporting obligations.

- Limited Personal Benefit: The primary focus is on charitable giving, limiting the direct personal benefit you receive compared to other investment strategies.

- Requires Careful Planning and Legal Counsel: Developing an effective strategy requires professional advice from attorneys specializing in charitable giving and tax planning.

Examples of Successful Implementation:

The Giving Pledge, spearheaded by Warren Buffett and Bill Gates, encourages billionaires to commit a majority of their wealth to philanthropy. MacKenzie Scott’s strategic approach to philanthropy, focusing on direct, large-scale donations, highlights the impact that focused giving can achieve. Community foundation networks across the UK provide examples of local impact and managed giving services.

Tips for Lottery Winners Considering this Approach:

- Start with a DAF for flexibility: DAFs are an excellent starting point for exploring strategic philanthropy.

- Consider Charitable Lead Trusts (CLTs) for estate planning: These trusts allow you to pass assets to heirs with reduced tax burdens while providing charitable benefits.

- Research causes thoroughly before committing: Due diligence ensures your funds are used effectively.

- Involve family members in giving decisions: This creates shared purpose and ensures alignment with family values.

- Work with attorneys specializing in charitable giving and tax law: Professional guidance is crucial for navigating the complexities of this strategy.

By integrating a philanthropic impact and tax optimization strategy into your lottery winners financial advice, you can transform a life-changing event into a world-changing opportunity. You not only secure your financial future but also leave a lasting legacy of positive change.

8. Professional Team Assembly and Ongoing Education

Winning the lottery is a life-changing event, and navigating the complexities of sudden wealth requires careful planning and expert guidance. That’s why assembling a professional team and committing to ongoing financial education is crucial for lottery winners seeking to protect and grow their newfound fortune. This crucial step deserves its place on this list because it provides a framework for long-term financial security, mitigating the risks associated with managing a large sum of money. For UK lottery winners, understanding the specific financial landscape, including UK tax laws and investment opportunities, is paramount. Implementing this advice effectively can mean the difference between a lifetime of financial security and the unfortunate stories of lottery winners who lose it all.

Building a comprehensive financial team involves engaging several key professionals. A fee-only financial advisor, acting as your central point of contact, can help create a holistic financial plan tailored to your individual goals and risk tolerance. They operate under a fiduciary duty, meaning they are legally obligated to act in your best interest. Critically for UK winners, they should be well-versed in UK tax laws and regulations. A chartered accountant (CA) or certified public accountant (CPA) can handle the complex tax implications of your winnings, ensuring compliance with Her Majesty’s Revenue and Customs (HMRC) regulations and optimising your tax strategy. An estate planner, ideally a solicitor specialising in trusts and estates, can help you structure your assets to minimise inheritance tax and ensure smooth wealth transfer to future generations. Finally, an investment manager, regulated by the Financial Conduct Authority (FCA) in the UK, can develop and implement an investment strategy aligned with your long-term financial objectives.

The importance of a fee-only compensation structure cannot be overstated. This ensures your advisors are compensated directly by you for their services, eliminating potential conflicts of interest that can arise with commission-based models. Fee-only advisors are incentivised to grow your wealth, not to sell specific financial products.

Beyond assembling your team, committing to ongoing financial education is equally important. This empowers you to understand the advice you receive, ask informed questions, and actively participate in managing your finances. Regularly reviewing your financial strategy with your team ensures it remains aligned with your evolving goals and adapts to changing market conditions. Organizations like the National Association of Personal Financial Advisors (NAPFA) offer valuable resources and educational opportunities. Although NAPFA is primarily US-based, their focus on fee-only financial planning provides valuable insights relevant to UK lottery winners seeking similar advisor relationships. Similarly, the Certified Financial Planner Board offers the globally recognised Certified Financial Planner (CFP) certification, signifying a commitment to high ethical and professional standards in financial planning. Look for advisors in the UK holding this designation.

Examples of successful implementation include the establishment of family office services for ultra-high-net-worth individuals, providing comprehensive wealth management under one roof. For those with slightly less substantial winnings, building a team comprising a CFP professional, a chartered accountant, an estate attorney, and an FCA-regulated investment advisor provides robust financial management.

Pros of this approach include expert guidance across all financial areas, reduced risk of costly mistakes, objective, fee-only advice, a comprehensive wealth management approach, and ongoing education and empowerment. Cons include significant ongoing professional fees, potential conflicts between advisors if not managed carefully, time investment required for coordination, the risk of over-relying on others without developing your own understanding, and the need for ongoing management of the team.

Actionable tips for lottery winners in the UK:

- Interview multiple professionals before selecting. Don’t settle for the first advisor you meet. Shop around, ask tough questions, and ensure a good fit.

- Ensure all advisors are fiduciaries. This legally obligates them to act in your best interest.

- Verify credentials and check references. Confirm their qualifications and experience through reputable sources like the FCA register for investment advisors.

- Establish clear communication protocols. Regular meetings and transparent reporting are essential.

- Invest time in your own financial education. Empower yourself to understand and participate in managing your wealth.

Building a strong financial team and committing to lifelong learning may seem daunting, but it’s the most effective way to protect and grow your lottery winnings. By taking these steps, UK lottery winners can ensure their newfound wealth provides long-term financial security for themselves and their families.

Lottery Winners Financial Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Take the Lump Sum and Invest Strategically | Medium – requires investment knowledge | Moderate – professional advisors recommended | High potential returns, no guaranteed income | Investors wanting control & growth | High returns potential, liquidity, estate benefits |

| Create Multiple Income Streams Through Real Estate | High – active management or managers needed | High – capital and property management | Steady income, asset appreciation | Those seeking passive income & diversification | Consistent cash flow, inflation hedge, tax benefits |

| Establish a Trust and Estate Planning Structure | High – complex legal setup | High – legal and ongoing admin costs | Protection, tax minimization, wealth transfer | Long-term asset protection & family planning | Tax savings, asset protection, professional management |

| The 50/30/20 Scaled Wealth Allocation Rule | Low – simple percentage-based allocation | Low – no specialized resources required | Balanced growth, spending, philanthropy | Beginners or those wanting simple discipline | Clear guidelines, balance priorities, easy to implement |

| Anonymous Claiming and Stealth Wealth Management | Medium – legal work and privacy protocols | Moderate – legal & security expenses | Privacy, safety, reduced solicitations | Winners in states allowing anonymity | Protects privacy, security, reduces fraud risk |

| Systematic Withdrawal Rate Strategy | Medium – requires disciplined adherence | Moderate – ongoing portfolio management | Predictable income, principal preservation | Retirees or long-term wealth sustainment | Sustainable withdrawals, inflation adjusted income |

| Philanthropic Impact and Tax Optimization Strategy | High – complex planning & legal counsel | High – legal, administrative, and giving costs | Significant tax benefits, social impact | Charitable-minded winners aiming legacy | Tax efficiency, social impact, family involvement |

| Professional Team Assembly and Ongoing Education | High – continuous coordination needed | High – ongoing professional fees | Expert guidance, risk reduction | All winners wanting comprehensive management | Expert advice, fiduciary standards, empowerment |

Charting Your Course to Financial Freedom

Winning the lottery can be a life-altering event, but managing that newfound wealth wisely is crucial for long-term financial security. This article has provided key lottery winners financial advice, covering essential strategies such as lump-sum investments, real estate ventures, trust establishment, the 50/30/20 wealth allocation rule, anonymous claiming, systematic withdrawals, philanthropic planning, and assembling a professional team. Mastering these concepts isn’t just about preserving wealth; it’s about building a foundation for a secure and fulfilling future, allowing you to make the most of this incredible opportunity. By taking these steps, you transition from simply winning the lottery to actively shaping your financial destiny and enjoying the true fruits of your success. From strategic investments that grow your wealth to philanthropic endeavors that create a lasting legacy, sound financial planning empowers you to live a life of purpose and abundance.

The journey to financial freedom requires careful planning and informed decisions. While this advice provides a strong starting point, remember that continuous learning and adaptation are key to long-term success. Want to increase your chances of experiencing this incredible journey firsthand? Explore Lucky Turbo Competitions at Lucky Turbo Competitions for exciting opportunities and potentially put this lottery winners financial advice to good use! They offer a unique and engaging platform to pursue your dreams, making the prospect of needing these financial tips a thrilling possibility.